Hospitality is one of the major sub-sectors of the tourism industry. In the Northern Territory (NT), the tourism industry aspires to sustainably market the Territory as the most desirable destination for visitors in Australia and the world at large. Its vision is to grow the visitor’s economy to $2.2 billion by 2020 and $2.51-$3.03 billion in 2030, measured by overnight visitor expenditure. To achieve this goal, the hospitality industry has been and continues to be guided by several policy documents. Notable among them is the Tourism Industry Strategy 2030. These policy documents outline the strategies and guidelines to develop the industry. One of the strategies of the guidelines is to increase the annual turnover and equip the workforce with the needed skills to meet both current and future demands through a strong partnership among relevant stakeholders such as NT Tourism, Tourism Top End, Hospitality NT, government and other industry players.

The hospitality industry is key and one of the most vibrant sectors that play a pivotal role in developing the Northern Territory’s economy. The industry provides accommodation, food and beverage services to locals, interstate and international visitors. The number of guests received in the NT reaches its peak in the dry season which stretches between May and September. The main attractions in the dry season are primarily national parks, such as Kakadu, Lichfield, Nitmiluk (Katherine) Gorge, and so on. Moreover, visitors travel to the NT to experience native animals, such as crocodiles in their natural habitat in animal conservation parks, or through jumping crocodile experiences in the Adelaide River.

The hospitality industry is key and one of the most vibrant sectors that play a pivotal role in developing the Northern Territory’s economy. The industry provides accommodation, food and beverage services to locals, interstate and international visitors. The number of guests received in the NT reaches its peak in the dry season which stretches between May and September. The main attractions in the dry season are primarily national parks, such as Kakadu, Lichfield, Nitmiluk (Katherine) Gorge, and so on. Moreover, visitors travel to the NT to experience native animals, such as crocodiles in their natural habitat in animal conservation parks, or through jumping crocodile experiences in the Adelaide River.

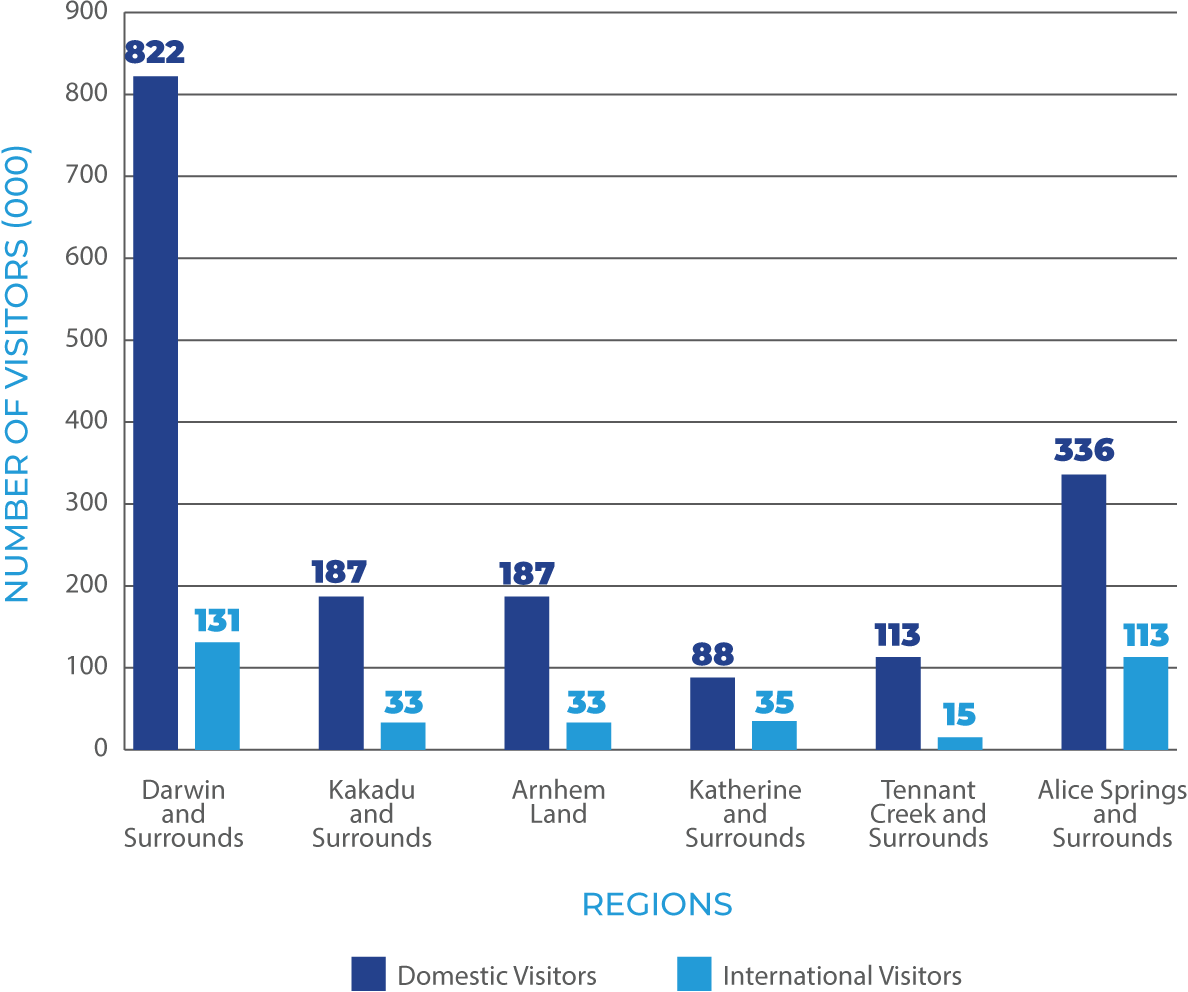

In 2018-2019, the hospitality industry in the Northern Territory provided excellent customer service, food, rooms, entertainment, and comfort to approximately 294,000 international visitors and 1.7 million domestic visitors. However, in 2019-2020 the visitor’s economy, especially international visitors, were projected to decrease. This is due to the novel coronavirus (COVID-19) pandemic affecting the entire globe, including Australia, the Twin Falls’ closure in Kakadu, and the global perception of the fire disaster in Australia. Engagements with relevant stakeholders within the hospitality industry during the first and second week of March 2020 revealed that businesses had been impacted by the outbreak of COVID-19 and the perception of the fire disasters in Australia.

The data analysis demonstrated that 72% of businesses had been heavily impacted and 28% had been impacted slightly/have not yet been affected by the COVID-19 pandemic and the fire disaster perception. Further analysis found that the effects of the COVID-19 pandemic were not the same across the industry as stakeholders in the accommodation sub-sector were impacted more than their counterparts in the food and beverage sub-sector. In addition, the effects of the pandemic on accommodation businesses were higher in regions such as Darwin and Alice Springs compared to areas like Katherine, Barkly and East Arnhem Land.

VISITORS IN 2018/2019

Source: Tourism NT, 2020

VISITORS SPENDING IN 2017-2018

Source: Tourism NT, 2020

The growth of the hospitality industry is critical to a thriving Northern Territory and a conduit to the achievement of the overall 2030 Tourism Strategy.

Hospitality NT, 2019

Types of Services

The hospitality industry is comprised of two main sectors, namely, the accommodation and the food & beverage sub-sectors.

TYPES OF ACCOMMODATION SERVICES

Hotels are the primary and most common form of accommodation with some providing state-of-the-art technology and facilities, overnight accommodation and housekeeping services for guests. Hotels also facilitate and provide meetings and conference services. They are classified by using five-star rating systems. In remote areas, hotels are sometimes referred to as lodges.

Motels provide affordable overnight studios, one, or two-bedroom accommodation units and sometimes food and beverage services for motorists. They are located along major highways with rooms mostly connected to each other, minimal amenities and doors facing the parking areas.

Serviced apartments are self-contained and offer both short and long-term accommodation services with fully equipped kitchens, working areas, laundry facilities, bedrooms and living areas that are fully furnished. Housekeeping is generally provided as part of the services.

Guesthouses are private residential homes that are converted into lodging facilities to provide affordable accommodation and sometimes food services for the exclusive use of guests. The owners of guesthouses may either live off-site or entirely in a separate area within the property.

Resorts are types of accommodation which offer overnight stays and provide guests with the opportunity to access restaurants, bars, recreation, entertainment options and shops on site.

Backpackers/hostels are a form of accommodation which provide overnight stays for multiple guests in the same living space with multiple bunk beds. Guests in backpackers/hostels share common areas such as kitchen and bathrooms and pay for a bed, rather than for a private room.

Bed and Breakfasts, popularly known as B&Bs, inclusive of AirBnB are private homes in which guests are offered private rooms for overnight stays, along with breakfast often included in the rate. Most owners and managers of B&Bs live on the property.

Caravan and Camping involves the use of either accommodation facilities at commercial sites (caravan parks, camping grounds or cabins) or non-commercial sites (self-drive vans, campervans and national parks).

TYPES OF FOOD AND BEVERAGE SERVICES

Cafés are small establishments sometimes with limited menu options where people order coffee, drinks and food from the counter. They are mostly open during the day.

Restaurants are eating establishments where professionals prepare and serve food and drinks to customers for consumption either at the premises, for take-out or provide food delivery options.

A pub/tavern/bar is an establishment with the license to sell alcoholic and non-alcoholic drinks and in some cases serve snacks and meals.

Catering services involve the provision of food services to sites such as hotels, hospitals, pubs, airlines, cruise lines, caravan parks, entertainment sites, or event venues.

Takeaways are eating establishments that prepare food for customers, to be consumed off the premises.

Size of the Industry in the NT

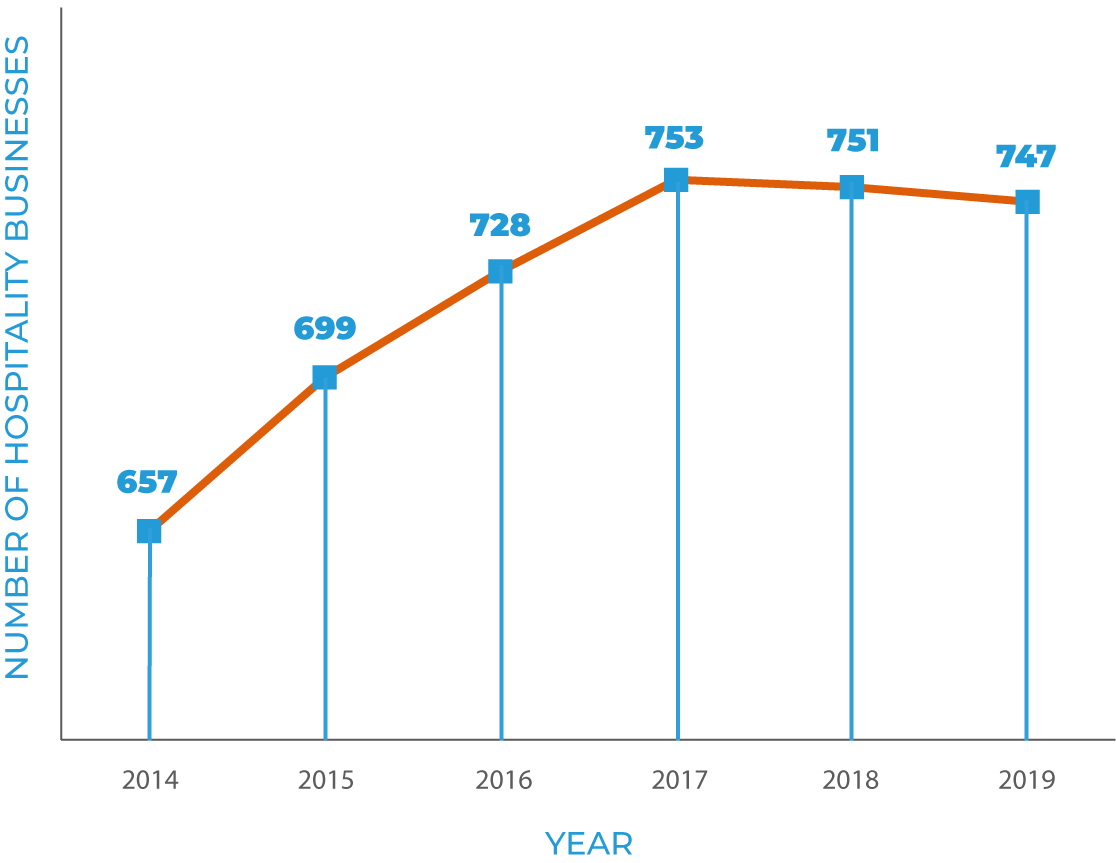

The size of the accommodation, food and beverage industry has been fluctuating in terms of the number of businesses in operation between 2014-2018. The number of businesses was at its peak in 2017, with the highest growth of 4.4% in 2014-2015. The growth in the size of the industry may be explained by the influx of people into the Northern Territory as a result of the Inpex Ichthys LNG Project, which started in 2012. This is supported by findings from Charles Darwin University’s research in 2012 that demonstrated that the primary reason people migrate to the NT is for work. The project’s construction stage required a large workforce base, especially between 2014-2017, leading to an increase in the NT’s population.

The expansion in the NT’s population, in turn, led to a higher demand for hospitality services, resulting in a leap of accommodation, food and beverage businesses. In 2017-2018, the wrapping up of many of the Inpex Ichthys LNG Project’s construction works resulted in the closure of many hospitality businesses, thus a shrink in the industry’s size. The industry’s decline could also be attributed to the ongoing trends of population fall in the Territory, particularly when projects are completed. Consequently, economic downturns in the NT at the end of mining-booms in certain regions further deteriorated the hospitality industry’s size. The sector has withstood the population declines and economic turbulence to some extent. This is the case, as there has been a steady growth in hospitality businesses as well as growth in contribution to gross state product over the past few years. This stable growth in the size of the industry is explained by the increase in visitor numbers utilising hospitality services.

Source: Australian Bureau of Statistics, 2014-2019

A strong and robust hospitality industry is needed to make the Territory a cruise destination and Darwin as a home port for expedition ships.

Economic Development Framework, 2017

Economic Contribution

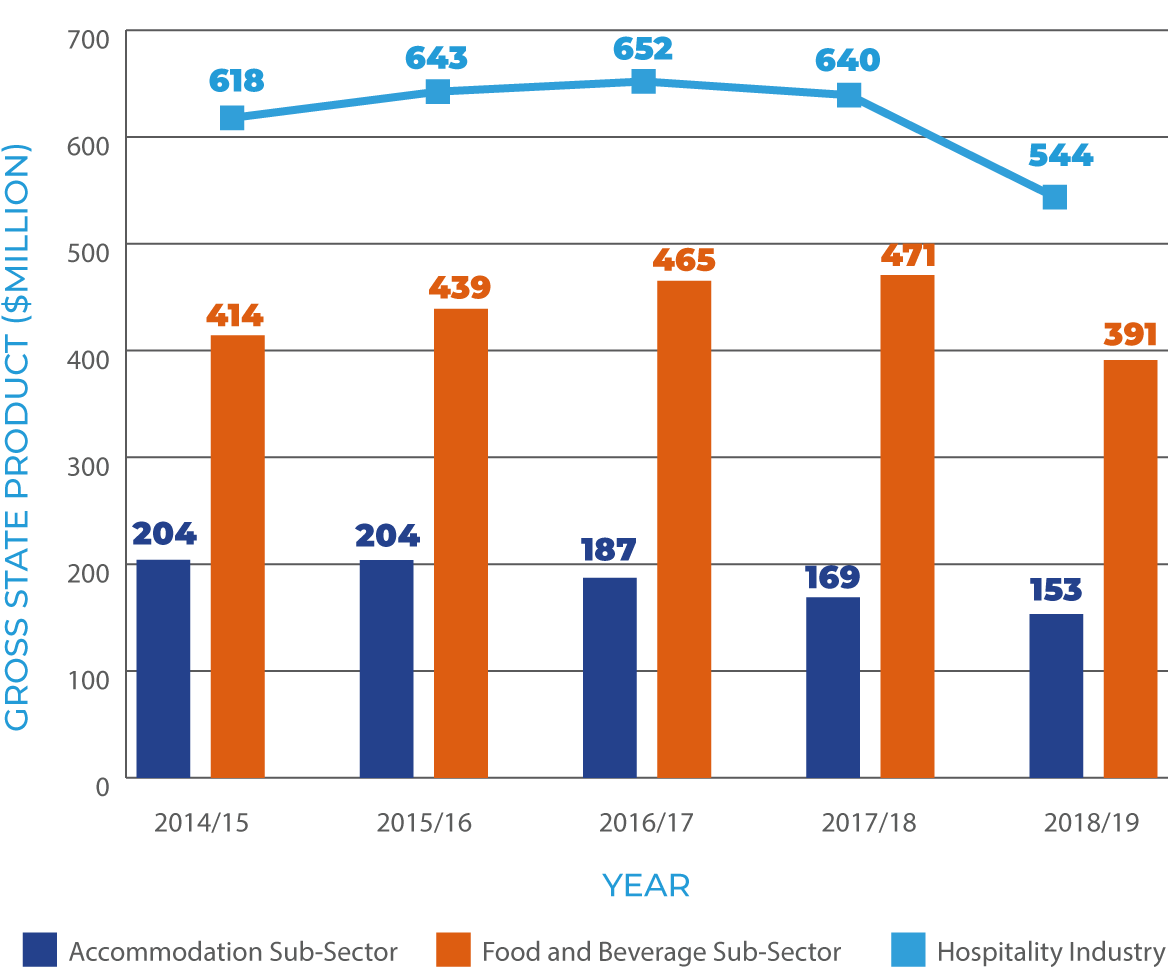

The hospitality industry’s contribution to the Territory’s gross state product (GSP) for the past few years cannot be overlooked. The industry has grown steadily from 2012/13 until its peak in 2017/18 with a GSP of $639.5 million and falling by 14.9% in 2018/19. Comparing the two sub-sectors for the past few years, the food and beverage sub-sector has followed a similar trajectory, growing since 2013. The economic contribution from the industry’s food and beverage sub-sector has grown steadily with an average growth of 5.5% since 2013. However, the accommodation sub-sector has decreased in GSP contribution occurring in 2013/2014. This demonstrates that the food and beverage sector has been the main pillar behind the growth of the hospitality industry over the years.

CONTRIBUTION TO GSP IN THE NT

Source: National Institute of Economic and Industry Research (NIEIR), 2019

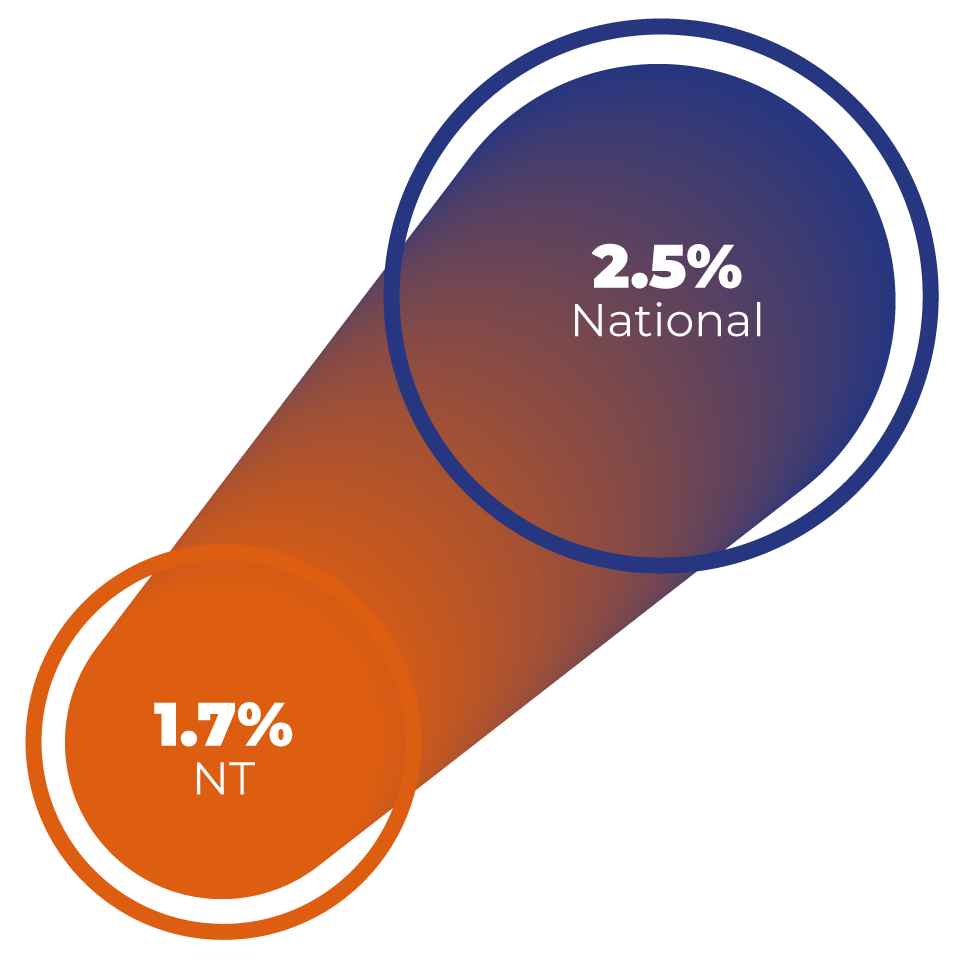

Average Growth from 2008-2018

Source: National Institute of Economic and Industry Research (NIEIR), 2019

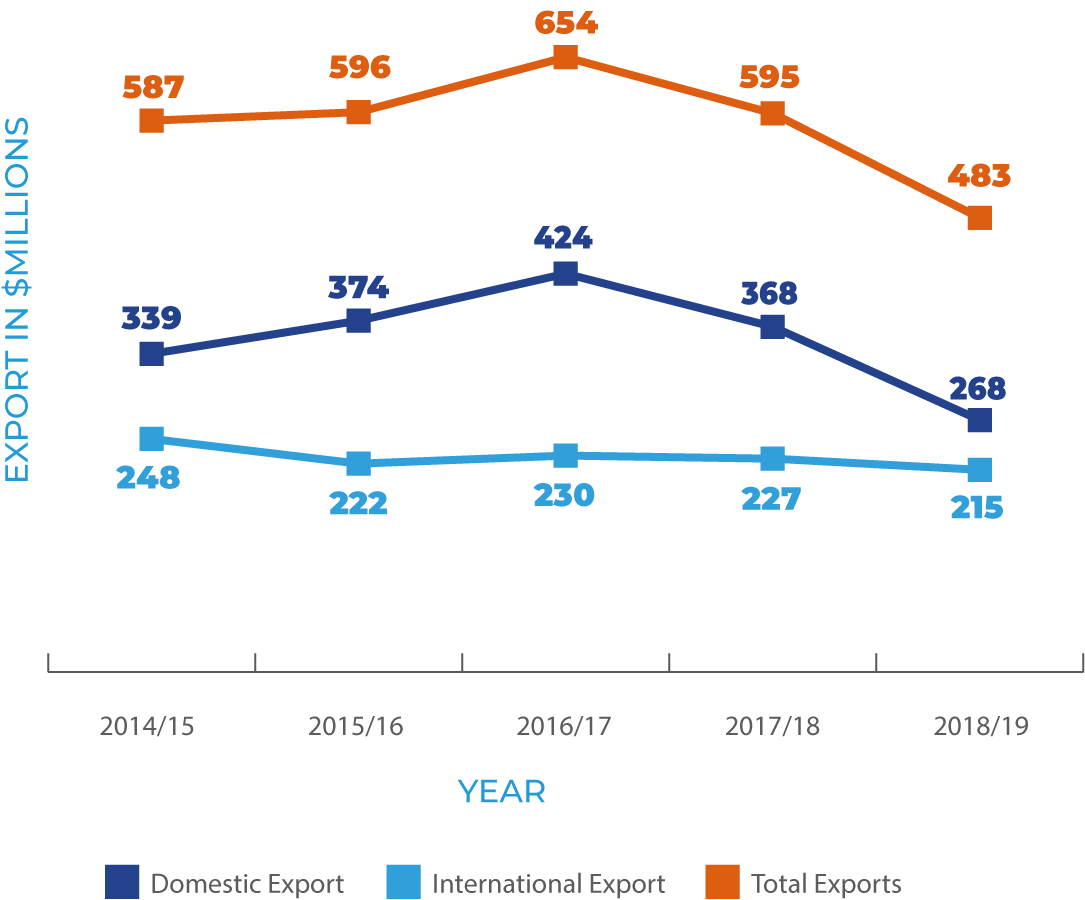

Hospitality's Contribution to Export in the NT

Industry exports are defined as sales of goods and services to non-resident households, businesses and other organisations, outside the NT. Exports from hospitality services are classified as domestic and international exports. On the one hand, domestic exports include all incomes generated from visitors from other Australian states through the provision of hospitality services. On the other hand, international exports refer to all income obtained through hospitality services from visitors outside Australia (international visitors). The total export from the hospitality industry has grown steadily since 2008. In 2016, the industry recorded its highest contribution due to higher demand for hospitality services by domestic and international visitors.

CONTRIBUTION TO export

Source: National Institute of Economic and Industry Research (NIEIR), 2019

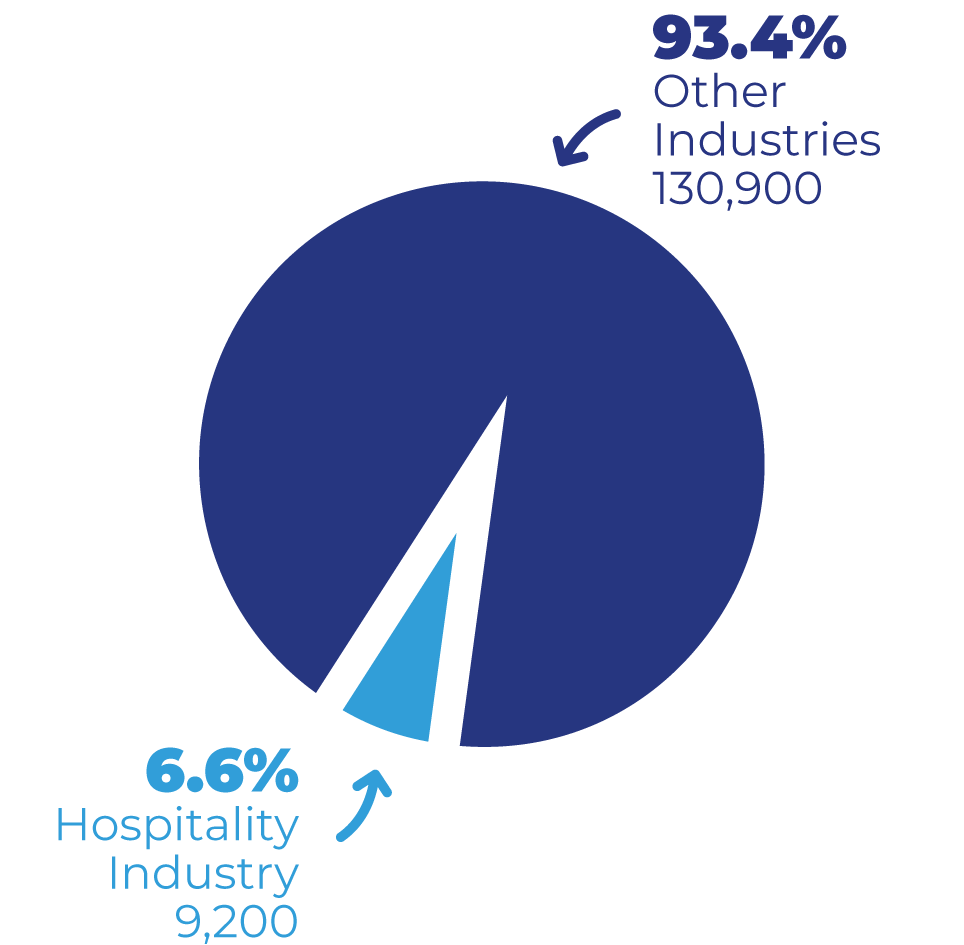

CONTRIBUTION TO EMPLOYMENT IN 2019

CONTRIBUTION TO EMPLOYMENT IN 2019

Source: ABS Labour Force Survey, 2019

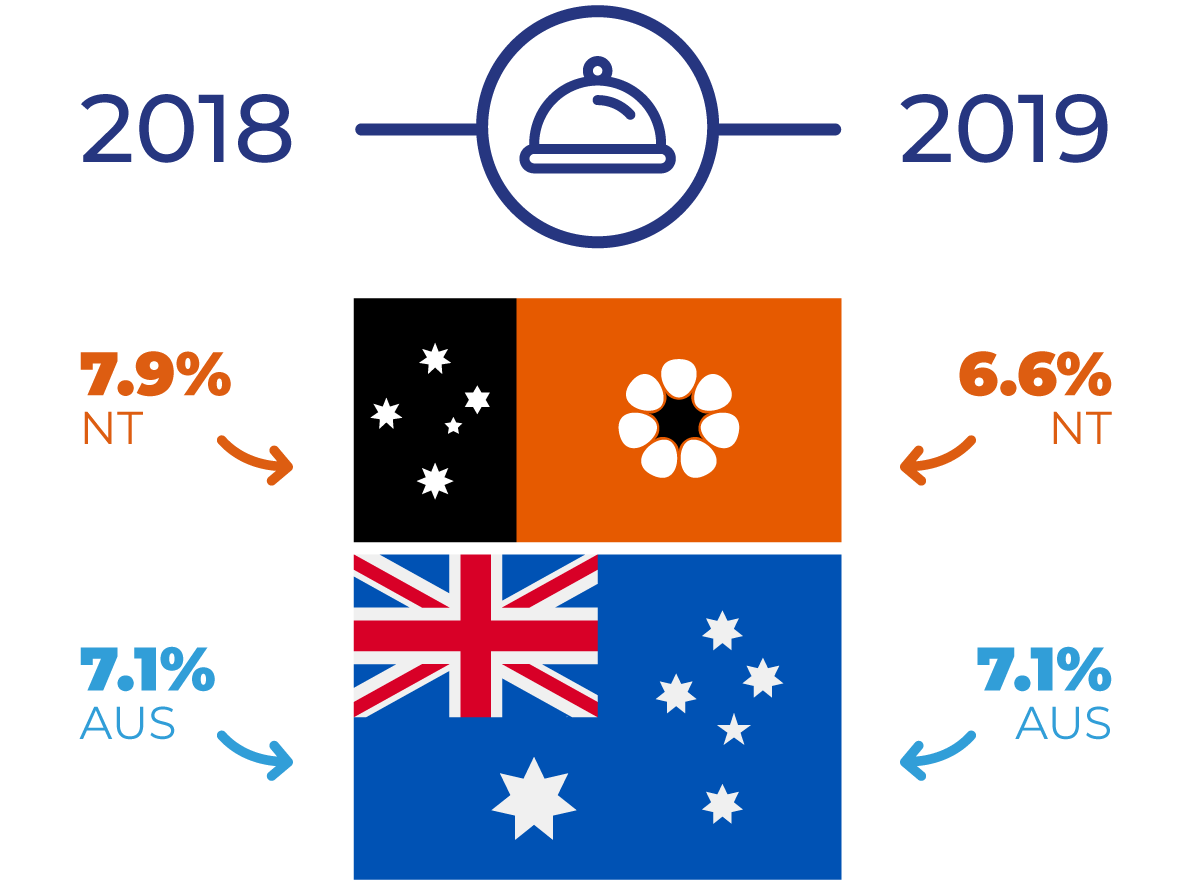

EMPLOYMENT PERCENTAGES

Source: ABS Labour Force Survey, 2019

SOURCES OF EMPLOYMENT

Source: ISACNT Field Survey, 2020

BASIS OF EMPLOYMENT IN 2019

Source: ABS, Labour Force Survey, 2019

Higher visitation to the Northern Territory Regions in the future shall result in an upward pressure on demand for hospitality services (accommodation, food and beverage), thus an expansion in the sector in terms of employment and economic contribution.

City of Darwin Economic Outlook, 2019

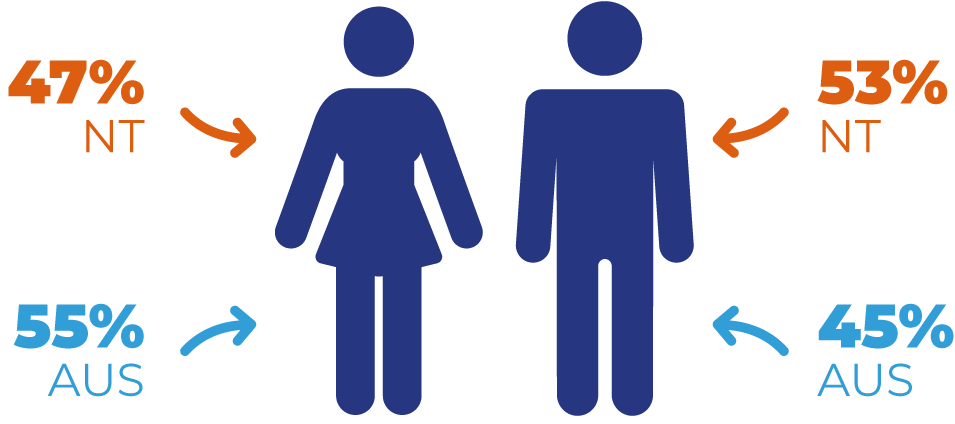

GENDER COMPOSITION OF THE WORKFORCE

In Australia, the workforce employed in the hospitality industry has a higher female population representation. However, in the NT, the situation is different as the industry employs more males than females. This may be explained by the NT’s general population characteristics that has more males than females. The ABS population data from 2013 to 2015 reflects a higher average representation of males (51%) than females (49%) in the Northern Territory.

GENDER COMPOSITION

Source: ABS, Labour Force Survey, 2019

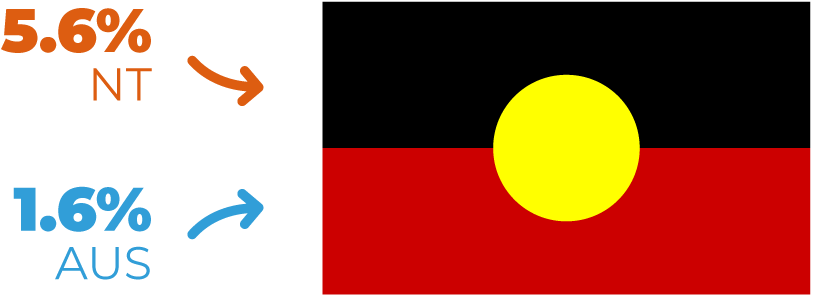

INDIGENOUS STATUS OF THE WORKFORCE

Aboriginal and Torres Strait Islander peoples are an integral part of the hospitality industry's workforce both in the Northern Territory and Australia, as a whole. The NT's hospitality industry employs more Aboriginal and Torres Strait Islander peoples than any other state in Australia. This implies that the NT is successful in engaging Aboriginal and Torres Strait Islander peoples, by providing them with the opportunity to learn new skills and trades. These impacts go a long way to improve existing workforce challenges in the industry.

ABORIGINAL AND TORRES STRAIT ISLANDER EMPLOYMENT

Source: Australian Bureau of Statistic, 2016

Workforce Challenges

For years, the hospitality industry has experienced skill shortages both in outer regional, remote and very remote areas. This trend threatens the Territory’s ability to provide world-class quality hospitality and tourism experiences. As a result, the industry has extensively relied on overseas workers, including working holidaymakers. Due to this condition, staff turnover has been high for many years. For instance, the high turnover rates of 91% and 53% were recorded in 2017 and 2019, respectively.

Factors inhibiting workforce recruitments in the hospitality industry include many job applicants having:

- limited working experience

- no relevant qualification

- no license and specialised skills

- reluctant feelings to migrate to remote and very remote areas

The hospitality sector's workforce needs, and challenges in the NT require proactive and practical solutions especially if the projected future industrial growth is not to be derailed.

Service Skills Australia, 2009

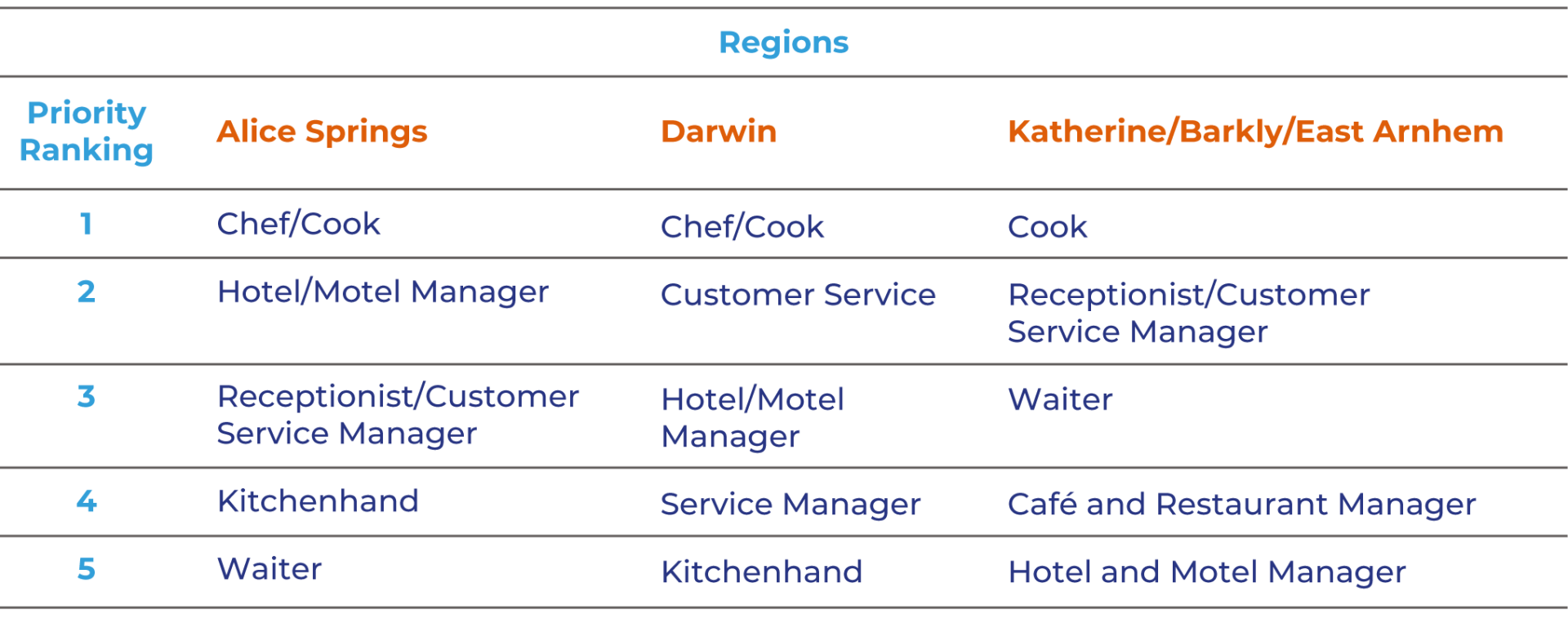

Occupations Difficult to Fill in the NT

Shift work, through history, has always been a pain point of many industries, including hospitality. One of the major challenges for the hospitality industry regarding its workforce is having workers adapt and adhere to shift work. The physical and mental demands of shift work pose a challenge to employees and employers. While it is an accepted part of most occupations in this industry, it has potentially affected attraction and retention rates. Engagement with stakeholders revealed that the reasons, why chefs and cooks are in shortage, is due to the nature of overnight and/or shift roster systems. This has forced some employers to take on less suitably qualified individuals affecting the quality of the output of the business, including the attraction and retention of its workforce.

Source: ISACNT Field Survey, 2020

A skilled workforce is an asset that ensures enhanced productivity, adoption of new technologies and global competitiveness. The development of the workforce base of any economy could be done in many ways. Education and training is only one of the major components of workforce development that focuses on individual learners and workers by equipping them with the relevant skills and conveying the required qualifications for the ever-changing world.

The hospitality industry is experiencing skill and staff shortages across all occupations, however, the responsibility for meeting the skills and staff needs of the industry is not confined solely to our education and training systems.

Tourism and Hospitality Workforce Development Strategy, 2009

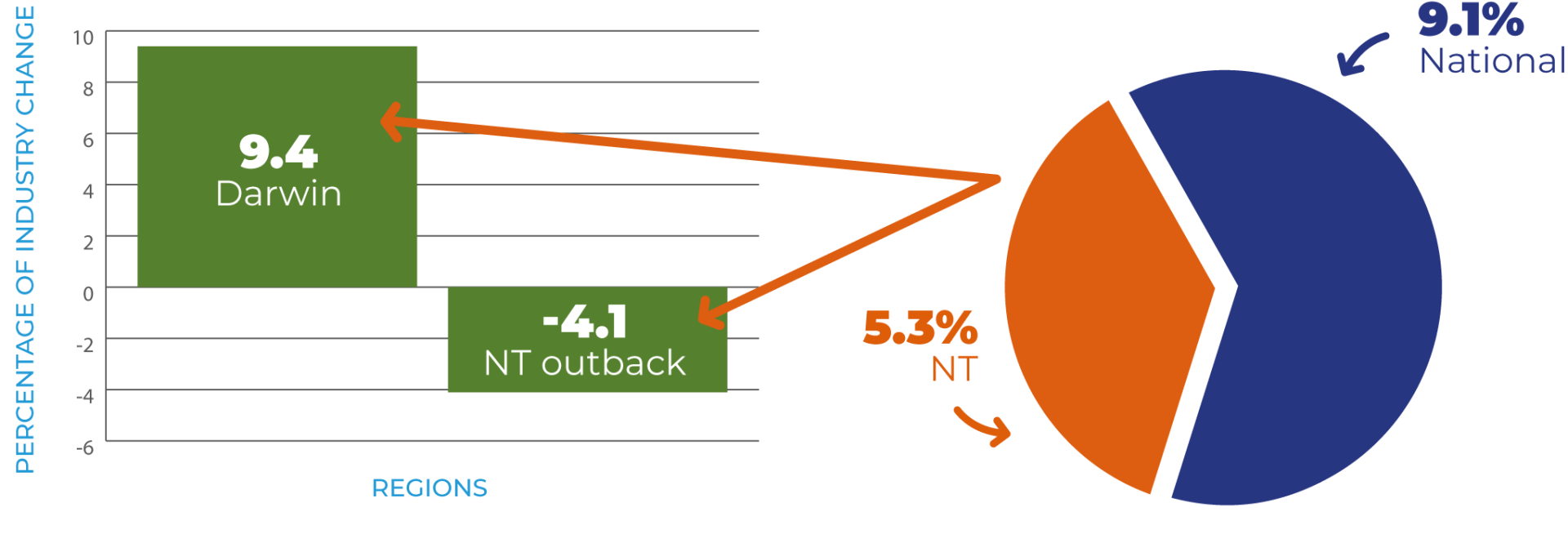

Where is the Hospitality Industry going?

The hospitality industry’s employment is projected to grow nationally across all states in Australia. In the NT, employment in the hospitality industry is expected to grow by 5.3% by 2023. The hospitality employment is projected to grow by 9.4% in the Darwin region, while employment in the NT’s Outback region is expected to fall by 4.1%. The decline in the hospitality industry’s growth in the outback regions may implicate ongoing challenges for already established hospitality businesses in remote towns/communities. The potential closure of remote business may have large impacts on the economy in the Outback NT region. The low traveller numbers in remote and very remote areas may further affect key facilities’ (such as roadhouses) ability to remain open to serve travellers and the local town/community’s needs. In effect, hospitality businesses’ closure may also force workers to move to outer regional areas like Darwin, or even migrate interstate to find work.

employment projections in 2023

Source: Department of Jobs and Small Business, 2018

The hospitality industry in the NT has been identified as one of Australia’s ‘high-growth’ sectors over the next two decades, with employment in the industry anticipated to grow considerably over the next years

Department of employment, skills, small and Family Business, 2019

Supply of Rooms in the NT

Given the tourism industry’s vision to grow the visitors’ economy to $2.2 billion, it is imperative to increase the supply of rooms to accommodate tourists. As a result, the accommodation sub-industry is projected to increase the supply of rooms to 10,672 in 2020 from 8,448 in 2014/2015.

It is the vision of the Territory to become the most preferred destination for visitors. To meet the growing demand now and in the future, an additional 205-225 rooms are required per annum. As a result, many projects have been proposed and completed to keep room occupancy at a viable and sustainable level.

supply of rooms in the nt

Source: Tourism NT, 2018

COMPLETED AND ONGOING PROJECTS

Source: Tourism NT, 2018

The adequate supply of accommodation is a critical factor for the Northern Territory tourism industry attaining the Tourism 2020 target of growing the visitor economy to $2.2 billion as measured by overnight visitor expenditure.

Tourism NT, 2017

Current State

Strenghts

SOCIO-ECONOMIC

- Clear guidelines (Northern Territory’s Tourism Industry Strategy 2030) to increase both domestic and international visitors now and in the future

- The strategic location of the NT to the fastest-growing markets in the world (Asia-Pacific Region) provides easy access to our regions boosting the hospitality industry

- Availability of adequate accommodation types (5-star, 4-star, 3-star, 2-star, motels and hostels) that cater for all types of visitor needs

- Culturally diverse nature of the NT with the availability of different cuisines is an attraction point for visitors

- The commitment of key stakeholders such as Tourism NT to initiate cooperative marketing campaigns, partnering with airlines to promote NT products and experiences

- Visitors high demand for Aboriginal and Torres Strait Islander peoples culture is a precursor for industry growth

- Increasing drive by businesses to provide quality services in terms of food and accommodation is key for the growth of the industry

- Commitment of the NT Government (NTG) to support and collaborate with the private sector to make the Territory a preferred destination hub for visitors. For example, the Darwin Cruise Ship Terminal

- Social media and digital marketing’s wider coverage help promote tourism and hospitality products in the NT.

*Investment of $2 million into the Tourism Resilience Plan as NTG grants and tourism vouchers will help minimise the impacts of bushfires and COVID-19 pandemic. The grants may also maintain the momentum in attracting more visitors to the NT, boosting the hospitality industry

WORKFORCE AND OCCUPATION

- Existence of clear guidelines (e.g., the Aboriginal Employment and Career Development Strategy 2015 – 2020) to increase Aboriginal and Torres Strait Islander peoples workforce participation and career development in all sectors including hospitality

- The willingness of overseas skilled workers to migrate into the NT (for example, Visa 482) is an avenue to increase the workforce base of the hospitality industry

- Availability of programs and strategies to increase the hospitality sector’s Aboriginal and Torres Strait Islander peoples workforce presence. An example is the Vocational Training and Education Centres (VTEC) Program

- Government support is available for the reskilling and upskilling of hospitality employees intended to increase the hospitality workforce skillsets

- The existence of educational awareness campaigns such as “Discover Hospitality” to motivate the youth to obtain a career in hospitality may increase the hospitality workforce

TRAINING AND SKILLS

- Access to the recognition of prior learning by registered training organisations (RTOs) allows for the transferability of skills which may increase the sector’s qualified workforce

- The ongoing development of hospitality courses ensures that students and workers are equipped with the required skills for the ever-changing industry

- Existence of well-established training organisations within the NT to train students/workers to meet the increasing skill demands of the industry

- Availability of funding for the traineeship and apprenticeship in hospitality courses across the NT to supplement the hospitality workforce

- Availability of technology and equipment to deliver hospitality-related programs to meet international standards

- Existence of experienced and qualified trainers to deliver hospitality-related courses to meet industry expectations

- High profile competition events (such as the NT Culinary Competition) improve the training and skills of trainees

Challenges

SOCIO-ECONOMIC

- Fluctuations in the hospitality market and visitor numbers in the dry and wet seasons affect and impede the growth of the industry

- The reduction of both international and domestic visitors’ arrival to the NT over the past years is a major hindrance to the industry’s growth

- Continuous closure of major attractions in key locations may affect visitor numbers in the NT

- Negative perception as displayed by certain media platforms in regional tourists’ areas due to high crime rates affect visitor numbers

- Global perception of bushfire outbreaks in Australia may affect the NT’s visitor numbers

- The solidarity of many domestic visitors to support tourism in bushfire impacted areas may reduce visitor numbers into the Territory

*Ban on travel from other parts of the world to Australia and the closure of state borders due to the outbreak of COVID-19 may impact the sector’s growth

*Major airlines’ withdrawal of flights to and from many parts of the world to Australia due to the COVID-19 pandemic will have a negative impact on the hospitality industry

*Please see disclaimer on the inside cover of the document

WORKFORCE AND OCCUPATION

- Businesses are often faced with inadequately skilled workers to help with the day to day operations

- The often remote nature of communities impedes workers/students possibility of obtaining a qualification and career in hospitality

- High attrition rates in hospitality courses compound existing workforce shortages and challenges

- Continuous fall in hospitality apprenticeships and traineeships have led to limited numbers of newly qualified workers entering the industry

- Restrictions and tightening of skilled migration pathways, partially due to the impacts of COVID-19, have created ongoing challenges

- The high cost of skilled labour in the NT often financially restrains businesses and impedes growth

- Reliance on the overseas workforce to overcome the skills shortage, gaps and recruitment difficulties impede the development of the local workforce

- The seasonal nature and negative perception attached to hospitality work, being temporary positions, makes it unattractive for people to pursue a career in the sector

- The unwillingness of skilled workers to migrate to remote/very remote areas implicate the already present workforce challenges

TRAINING AND SKILLS

- Limited competition due to the small number of RTOs delivering higher-level VET qualifications

- NT based RTOs do not regularly organise refresher training/courses for hospitality workers to acquire additional skills for currency within the industry due to lack of industry demand

- The hospitality industry does not have standardisation in training on a Federal/State level which may affect the consistency of student outcomes and employer expectations

- RTOs in the NT may find it challenging in the redesign of hospitality courses to align with the changes that occur within the industry

- Training institutes may experience some difficulty retaining trainees as high volumes of enrolments but low completion rates reflect a disparity in the NT

*Social distancing measures in place due to COVID-19 may affect the practical training delivery components as offered by RTOs

Future State

Opportunities

SOCIO-ECONOMIC

- The NTG continues to invest in tourism infrastructure to improve enjoyable and safer visitor experiences sustaining visitor demand for hospitality products

- Federal Governments recent initiatives to consolidate existing hospitality data sources into a comprehensive labour force information system will create an opportunity for NT businesses to advertise and fill vacancies from recognised low-cost sources

- Australia has a renowned reputation globally of providing quality hospitality services that meet international standards, in particular, the NT is recognised for delivery of authentic outback experiences

- Peak organisations, such as the Australian Hotels Association & Restaurant and Catering Australia’s continued commitment to influence policies at the national level improve the sector’s operating environment in the NT

WORKFORCE AND OCCUPATION

- Availability of loans such as VET Student Loans assist NT students to pay course fees and encourage higher enrolment numbers

- The Federal Government initiatives of making regional areas, such as the NT, attractive to skilled migrants is a strategy to increase a local supply of the workforce base of the hospitality industry

- Reviewed employer-sponsored and regional visas may help to attract more skilled workers into the NT's industry

- NTG provides continuous support for apprenticeship and traineeship programs to help boost the workforce

- Northern Territory and Federal Government initiatives and support mechanisms are available to assist Aboriginal and Torres Strait Islander peoples in securing sustainable jobs in hospitality

- Current strategies are in use by the NTG to attract more visitors during off-peak seasons, utilising hospitality products such as niche events

TRAINING AND SKILLS

- National process to develop industry-standard of skills through VET qualifications supported by industry input

- Federal Government continuous support of the Australian Skills Quality Authority (ASQA) to effectively regulate RTOs operations and maintain the quality of vocational education and training delivery in the NT

- There are sufficient opportunities for NT students to apply learning in a realistic work environment through work placements/apprenticeships

- Sustained increase in demand for funded NT apprenticeships allow trainees to complete the qualification while earning, increasing the size of the workforce

Threats

SOCIO-ECONOMIC

- The effort of other Australian state government initiatives to make tourism more attractive may reduce visitors’ numbers to the NT

- Effective partnership between airlines and other Australian states to market tourism experiences may reduce visitors’ numbers to the NT

- Loss of multiple full-service airlines and the high cost to travel into the NT reduce the supply of visitors to Territory destinations

- Limited flight schedules often with inconvenient arrival/departure times greatly hinder the growth of the visitor economy in the Territory

- There are too few local investors to fund infrastructure for the promotion of the tourism industry in the NT

WORKFORCE AND OCCUPATION

- Keen competition from other states in attracting skilled workers in the industry may worsen existing NT workforce challenges

- Inadequate government initiatives to support existing skilled workers retention in the industry may impede the development of the hospitality sector in the NT

- Legislative changes will continue to impact the reduction in one of the NT’s major sources of labour for the hospitality industry (working holiday visa holders), deteriorating existing workforce skill shortages

- Unsuccessful workforce programs and initiatives to increase participation rates especially among the Aboriginal and Torres Strait Islander peoples and people with disabilities affect workforce numbers in the NT

- The high employee turnover rates in the NT, especially during off-peak seasons, create fewer opportunities for sustained operations in the hospitality industry year-round

- There are inadequate initiatives for employee retention and promotion within NT businesses to encourage existing hospitality workers to commit to a career in the industry

TRAINING AND SKILLS

- Access to delivery of structured training not conducive to attracting existing workers to pursue new or higher qualifications in hospitality

- Some NT businesses are experiencing low confidence in outcomes provided by RTOs due to inconsistent course compositions, creating a lack of credibility in vocational learning for hospitality skilling

- Competition for the determination of lead agencies to help define industry standards for training may impede in developing future frameworks and national training products

- Limited choices in apprenticeship delivery of training available in the NT restrict opportunities for accelerated learning and completion

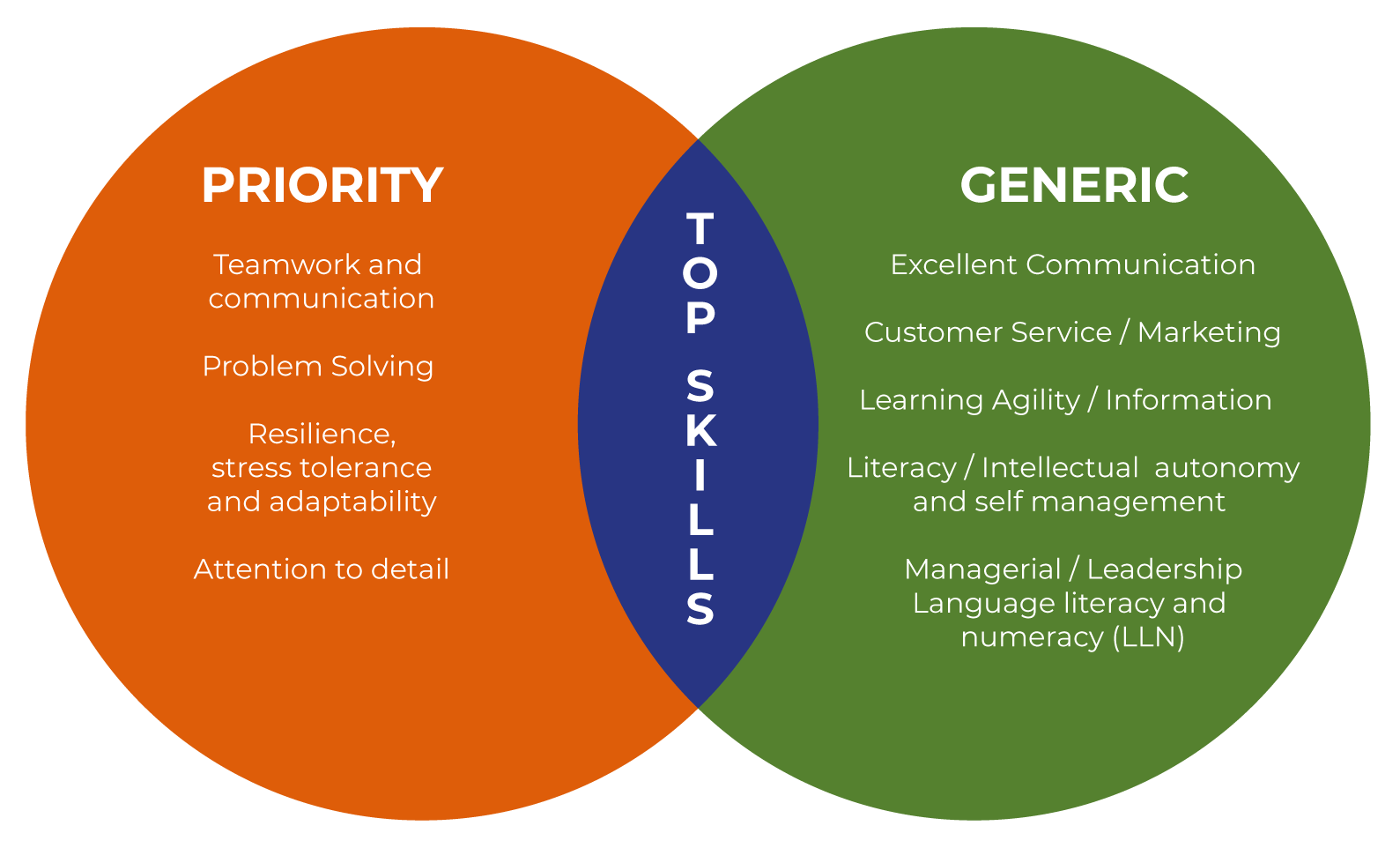

Skills in Demand

The growth of the hospitality industry is highly dependent on the quality of its workforce. The skills required by most employers are grouped into priority skills and generic skills. These highly prioritised skills are known as soft and hard skills by most industry players. Soft skills are personality traits that characterise relationships between hospitality workers and customers/clients. They include personal competencies such as social aptitudes, time management, communication capability, friendliness, and teamwork. The soft skills complement the hard skills. Hard skills refer to the specific and technical competencies obtained mostly through education and training to perform tasks. For instance, skills such as the ability to recognise flavours, judging the balance of seasoning, knowledge of the kitchen, tasting, and cooking precisely and efficiently are critical hard skills chefs are required to obtain to be successful.

Source: Tourism, Travel and Hospitality IRC, 2019

In order to deliver an internationally competitive hospitality services, governments and other stakeholders must make it easier for the industry to up-skill its existing workforce and find suitable skilled workers when need be.

Australian Government, 2020

Occupations

CAFÉ AND RESTAURANT MANAGERS

ANZSCO # 141111 Café and restaurant managers

organise and control the operations of cafés, restaurants and related establishments to provide dining and catering services.

Skill Level: 2

OR

Bachelor of Culinary Management

CHEFS / COOKS

ANZSCO # 351311 Chefs plan and organise the preparation and cooking of food in dining and catering establishments.

Skill Level: 2

ANZSCO # 351411 Cooks prepare, season and cook food in dining and catering establishments.

Skill Level: 3

OR

Bachelor of Culinary Management

HOTEL AND MOTEL MANAGERS

ANZSCO # 141311 Hotel and motel managers organise and control the operations of hotels and motels to provide guest accommodation, meals and other services.

Skill Level: 2

OR

Bachelor of Culinary Management

HOTEL SERVICE MANAGERS

ANZSCO # 431411 Hotel Service Managers supervise and coordinate the activities of hotel service workers.

Skill Level: 3

OR

Bachelor of Culinary Management

Enrolments and Completions

Resources

http://www.governessaustralia.com/info/whatisagoverness.html

https://nteconomy.nt.gov.au/industry-analysis/agriculture,-foresty-and-fishing

https://www.agriculture.gov.au/abares/products/insights/snapshot-of-australian-agriculture-2020

https://www.pc.gov.au/research/completed/agriculture/agriculture.pdf

https://www.austrade.gov.au/agriculture40

https://economy.id.com.au/rda-northern-territory/value-add-by-industry

https://ntfarmers.org.au/wp-content/uploads/2018/11/2019HarvestReport_Final.pdf

https://ntfarmers.org.au/wp-content/uploads/2018/11/2018-Harvest-Labour-Report.pdf

https://ntfarmers.org.au/wp-content/uploads/2018/11/NT-2017-Harvest-Labour-Report-Final.pdf

https://industry.nt.gov.au/__data/assets/pdf_file/0004/948748/economic-overview-2018-2019.pdf

https://dpir.nt.gov.au/__data/assets/pdf_file/0005/443255/outlook-overview-2016.pdf

https://www.agriculture.gov.au/abares/research-topics/aboutmyregion/nt

https://nteconomy.nt.gov.au/industry-analysis/agriculture,-foresty-and-fishing

https://publications.csiro.au/rpr/download?pid=csiro:EP186191&dsid=DS3

Disclaimer Privacy Policy

Website designed and developed by Captovate