Mining is a labour-intensive process that the human race has participated in since prehistoric times. It is the process of extracting minerals, oil and gas (otherwise known as commodities) which are essential to most industries and people. These minerals have a vast range of uses in everyday life. The opportunities from the mining industry are numerous, the modern world would not function without the mining industry. Naturally mined resources are essential to produce all modern technologies that are used in contemporary life, this for example, includes the development of life-support device technologies that are used within the

medical field to improve human health.

In a given location, the total quantity of minerals in a particular deposit is referred to as the mineral inventory, however, only the quantity which can be mined at a profit is termed as the ‘ore reserve’. Consequently, if the selling price of a commodity (e.g. iron, copper, manganese, etc.) rises or the cost of operations fall, it affects profit margins. A mine may cease production for several reasons. For instance, the deposits may become exhausted (no more minerals to extract from the ground economically or all minerals are mined out). When this occurs at a mining site the operations transition into a new phase called rehabilitation. Commodity prices may have dropped to such an extent that is no longer profitable to continue mining operations, and the same holds true if operational costs rise.

Mines operating in the Northern Territory (NT) undergo the same scientific, administrative and construction processes comparable to other mines across the globe. The mining industry is the single largest source of export revenue for Australia and the sector continues to be amongst industry champions in driving innovative enhancement. The Northern Territory’s contribution to the gross domestic product (GDP) of Australia cannot be underestimated.

Industry activities and services

The mining sector includes operations that explore and extract minerals, oil and gas. The mining sector provides a variety of

services to firms engaged in the listed activities.

The phases of mining

A mine site’s journey has humble beginnings but goes through an array of changes from an untouched area of land to accommodating state-of-the-art infrastructure. The initial phase of exploration identifies an area of land that may be rich in a particular commodity (e.g. oil, gas, gold, copper, iron, and other rare earth minerals). From a business perspective, it is extremely important to keep profit margins in mind, when evaluating potential mineral deposits.

Following initial regional exploration, areas may be selected for more intensive exploration investigation. When this phase is reached, significant greater investment is required to evaluate and

investigate the economic viability of these resources. Intensive and focused explorations are completed to determine the quantity and grade of the potential resource. Ultimately, if the project has the potential/ justification for investment, mining operations can commence. When the approved mine site has been established, the operation commences by first constructing the infrastructure around the mine site which is used to support extracting, processing and shipping of the commodity to its designated location, which include markets overseas.

The importance of mining cannot be understated. The world today cannot function without the commodities that are extracted and recovered from mining activities. Mineral products are essential in the manufacturing of a spectrum of products such as mobile phones, batteries and much more. Australia had the world’s third-largest reserves of lithium, measured in 2016, and is the largest producer of lithium in the world. Australia is ranked sixth in the world for having the most sought-after rare-earth elements.

Moreover, Australia is ranked second for production of these elements, yet many of these deposits remain untapped.

Australia also has large resources of cobalt, manganese, tantalum, tungsten, zirconium and iron ore.

The demand for critical minerals around the world is growing.

As neighbouring countries with younger population demographics become further developed so does their demand for manufactured goods. The opportunities for foreign entities to invest in mining presents a potential economic stimulus for the Northern Territory (NT).

As a country, Australia has an attractive investment environment and the new sources of capital being brought into the NT is crucial to the development of Australia’s critical minerals sector.

Rare earth elements (ree) in Smartphones

Mining in the Northern Territory

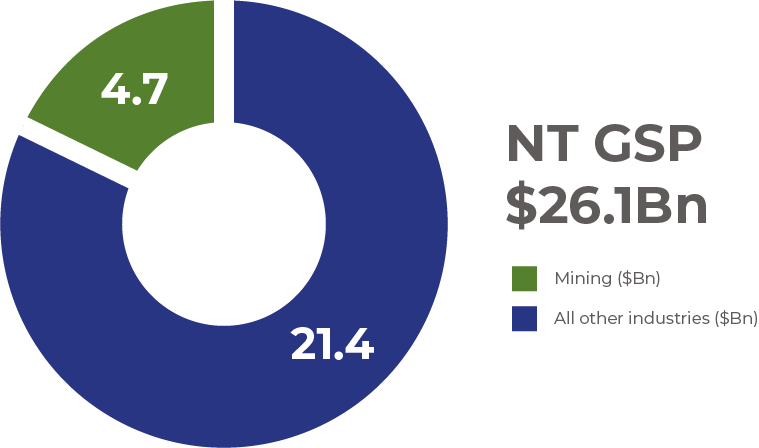

The mining industry of the Northern Territory (NT) is one of the mainstays of the economy, contributing immensely to the gross state product (GSP). Additionally, the industry has over the past few decades remained and continues to be a key pillar of the Australian economy. The mining industry is also responsible for creating and sustaining employment, especially in regional areas. The mining industry in 2018-2019 was the second-highest contributor to the Territory’s GSP accounting for 18% of the total contribution. In terms of employment in the Northern Territory, 5.2% of the Territory’s workforce was employed in the mining industry in 2019. The diagram reveals the scale of the contribution of mining towards the GSP in 2019.

Source: Northern Territory Government, 2019

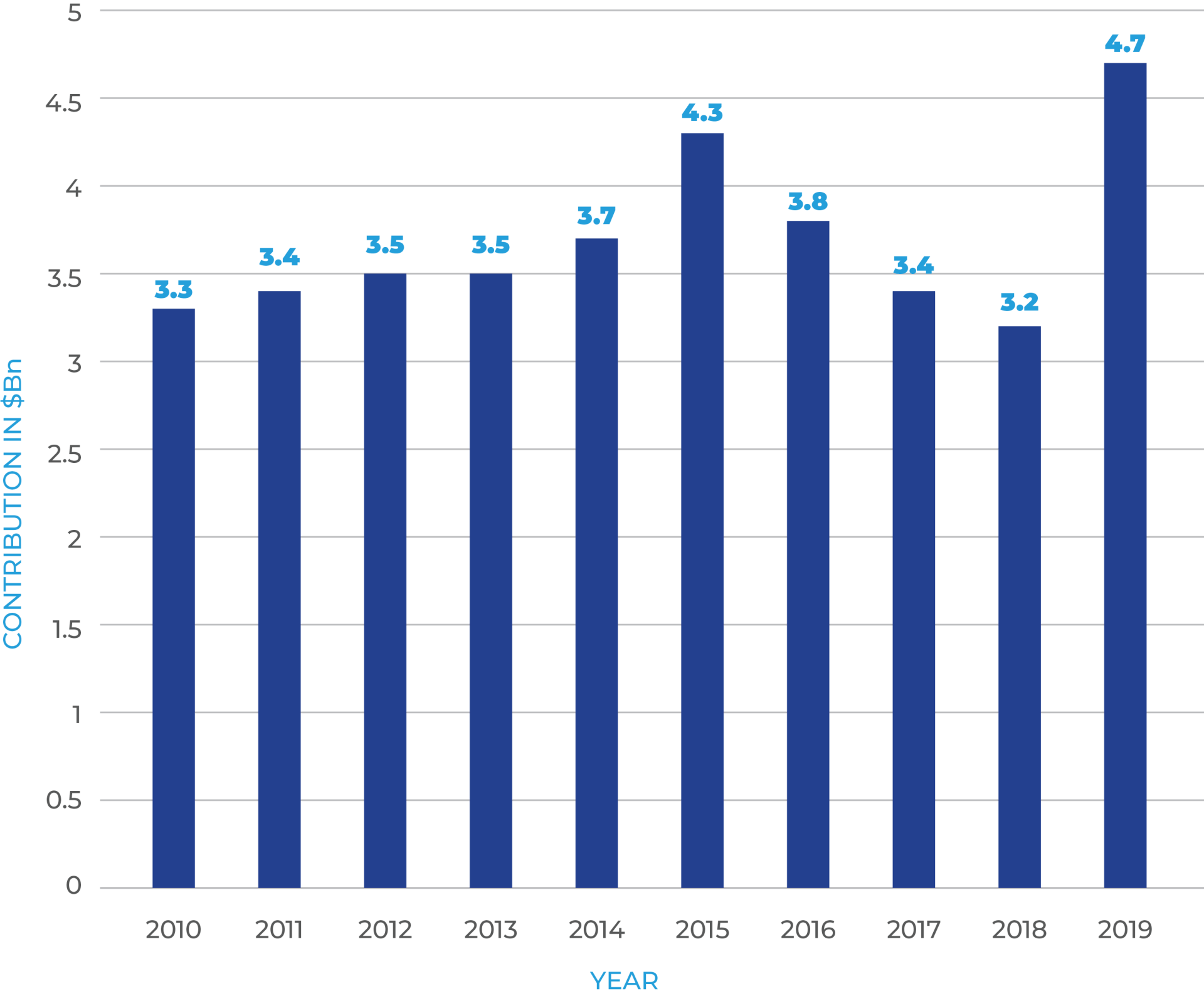

Contribution of Mining to the Northern Territory's gross state product 2010-2019

Despite the enormous contribution of the mining industry to the Australian and the Northern Territory’s economies, it is not without challenges. Workforce shortages, in particular occupations, are increased during heightened activity periods. Existing reports show that the demand for the workforce relevant to mining far exceeds the supply. The nature of the sector ensures high economic impact in any setting. The lucrative returns of mining activity lure many stakeholders to the table. It is important for relevant local stakeholders to benefit from the opportunities associated with these projects. With a high expectation of the Northern Territory Government (NTG) and relevant stakeholders to achieve local content at contractual, supply and workforce levels, organisations including supporting industries are required to understand the work associated with the various stages of the project.

The mining contribution over a ten-year period paints a telling picture of how significant the mining industries contribute to the overall gross state product (GSP) of the Territory. If this important sector of the economy was missing, it would have severe consequences within the Australian and NT’s economies.

Source: Northern Territory Government, 2020

The Northern Territory’s Gulkula mine is Australia’s first Indigenous-owned mine operation. The Gulkula mine is located in Arnhem Land and delivers all stages of the bauxite mining process. The mined bauxite is used to create aluminium. The Gulkala mine employs Indigenous people at all stages of the mining process, as the mines key vision is to empower Indigenous people towards economic independence through continuous exposure to job training within the mining industry. The Gulkula mine, furthermore, highly values honesty, rehabilitation and respect.

ISACNT - Central Five Mines Workforce Report

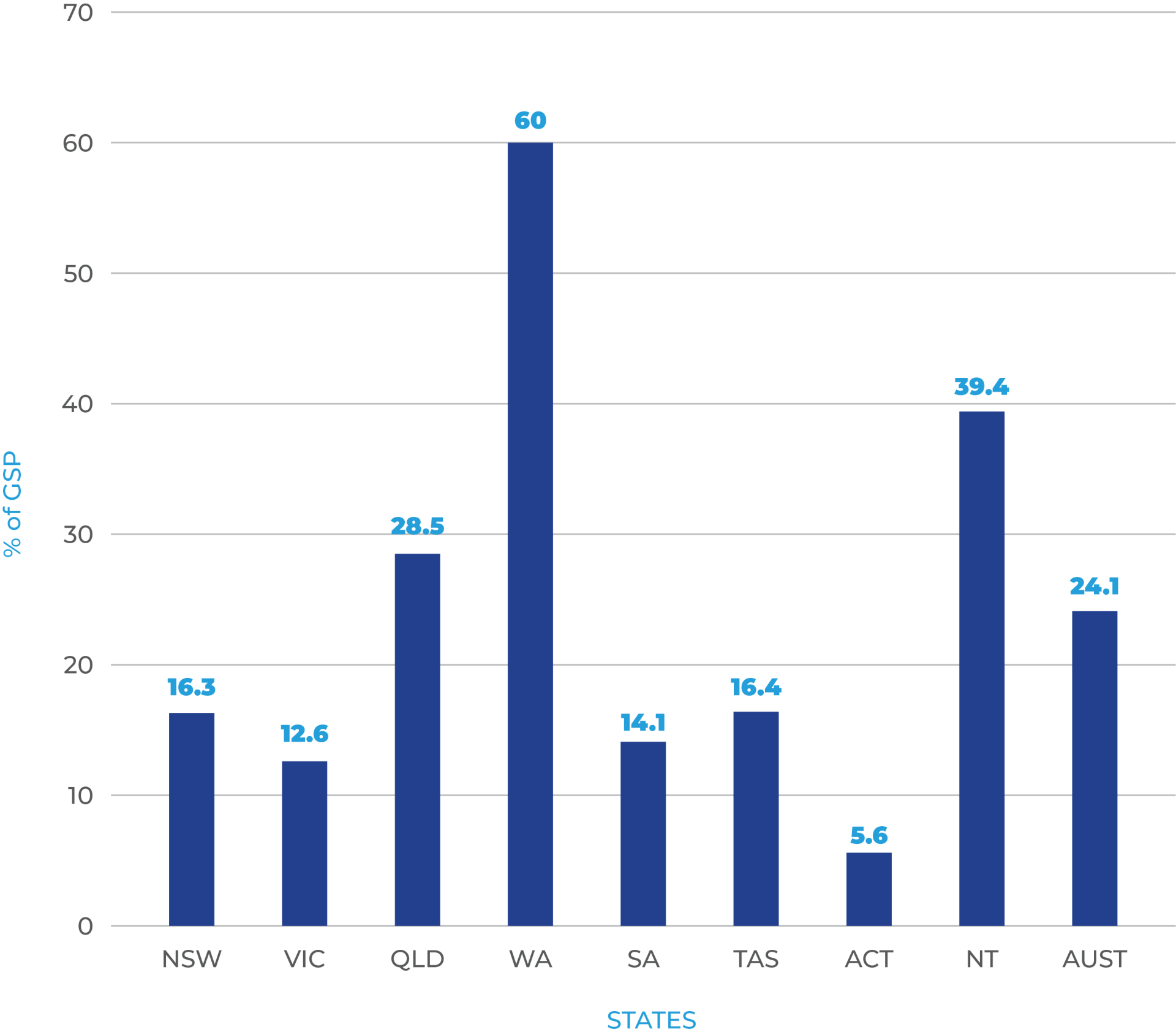

Comparaison of total Mining exports as at Jun 2019 (% of grosse state product)

The graph shows the Northern Territory’s (NT) reliance on mining comparative to other resource rich mining states like Western Australia and Queensland. The NT had the second-highest level of exports as a share of GSP in 2019. The NT is a resource-reliant jurisdiction in Australia as this graph demonstrates, 39.4% of the exports originate from the mining industry. The NT’s mining industry thus provides a large scale of importance for the local economic situation. Consequently, changes within the mining industry or regulatory settings could potentially limit the mining activities which may have significant impacts on the economic situation and the NT’s ability to grow and prosper financially.

Source: Northern Territory Government, 2019

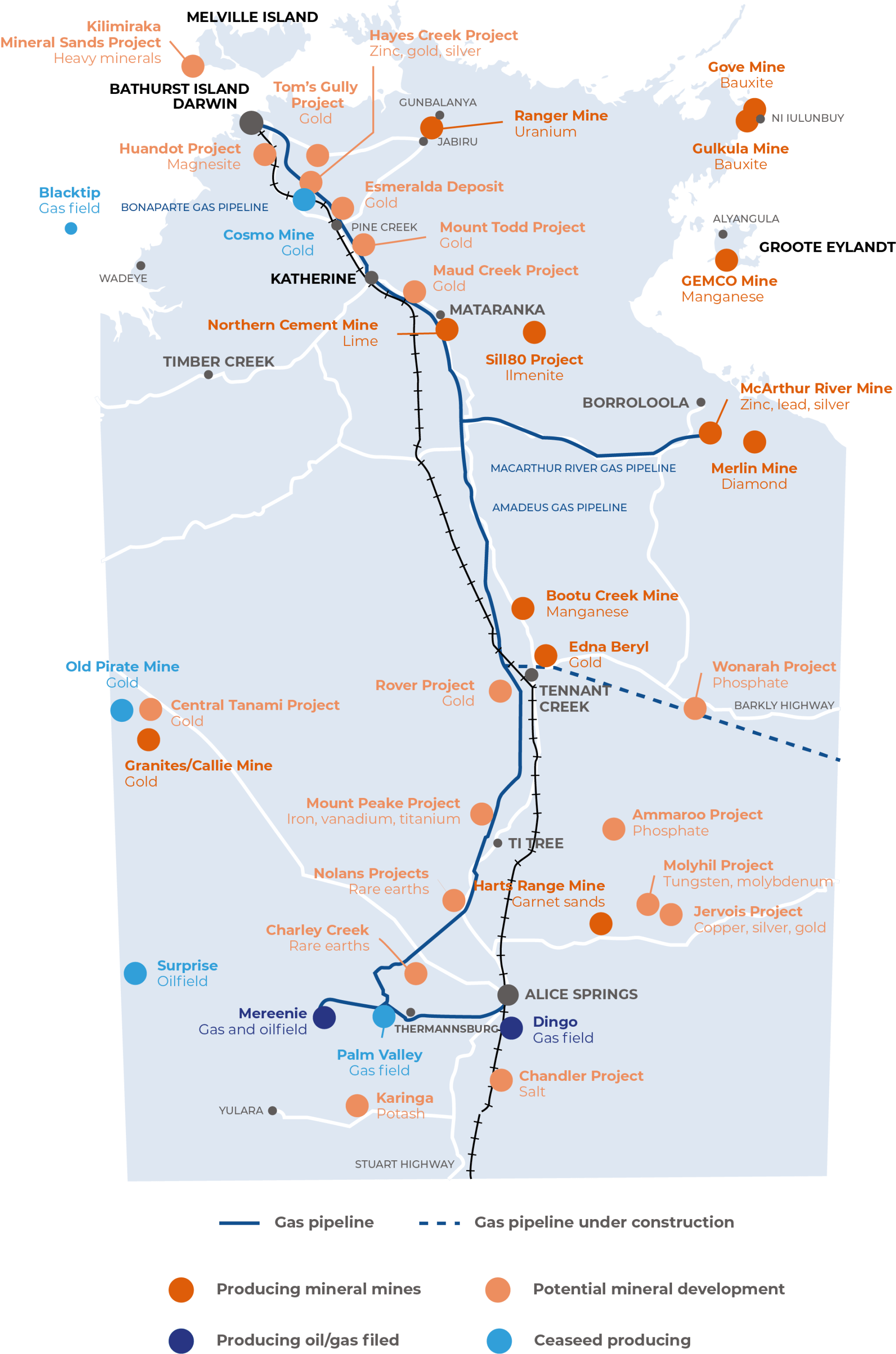

Minerals in the Northern Territory

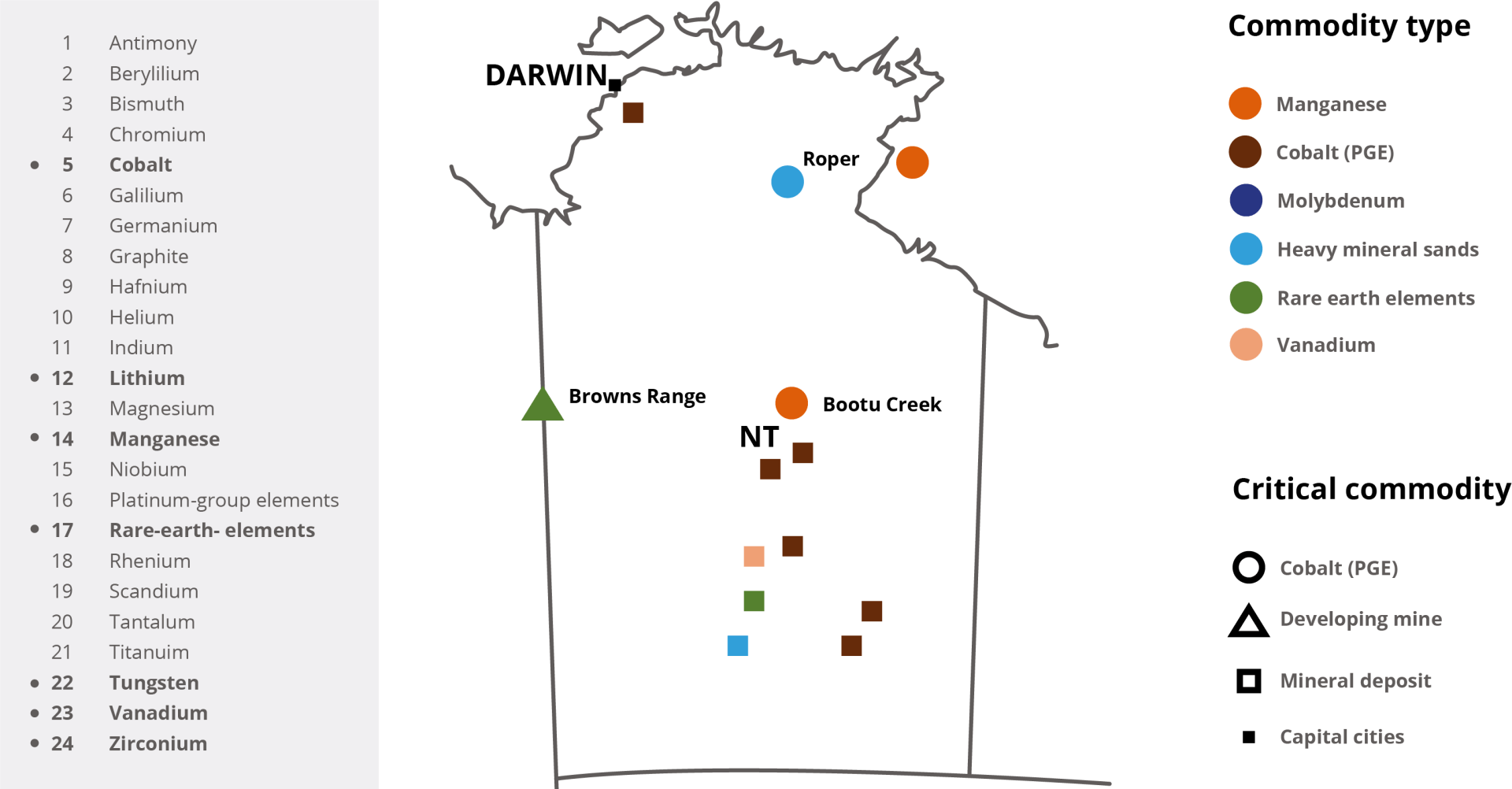

The map displayed depicts operating mines and mineral deposits in the Northern Territory (NT). The legend indicates what type of commodity is available in the Territory. A list of the 24 critical minerals has been identified by the Australian Government as essential for the economic and industrial development of major and emerging economies in the world. Seven of the identified critical minerals are in deposits in the Territory as highlighted. It should also be noted that other commodities like Gold, Bauxite, Zinc, Lead, Ilmenite, Uranium and other non-metallic minerals are mined in the Northern Territory

Potential mining developments in the Northern Territory

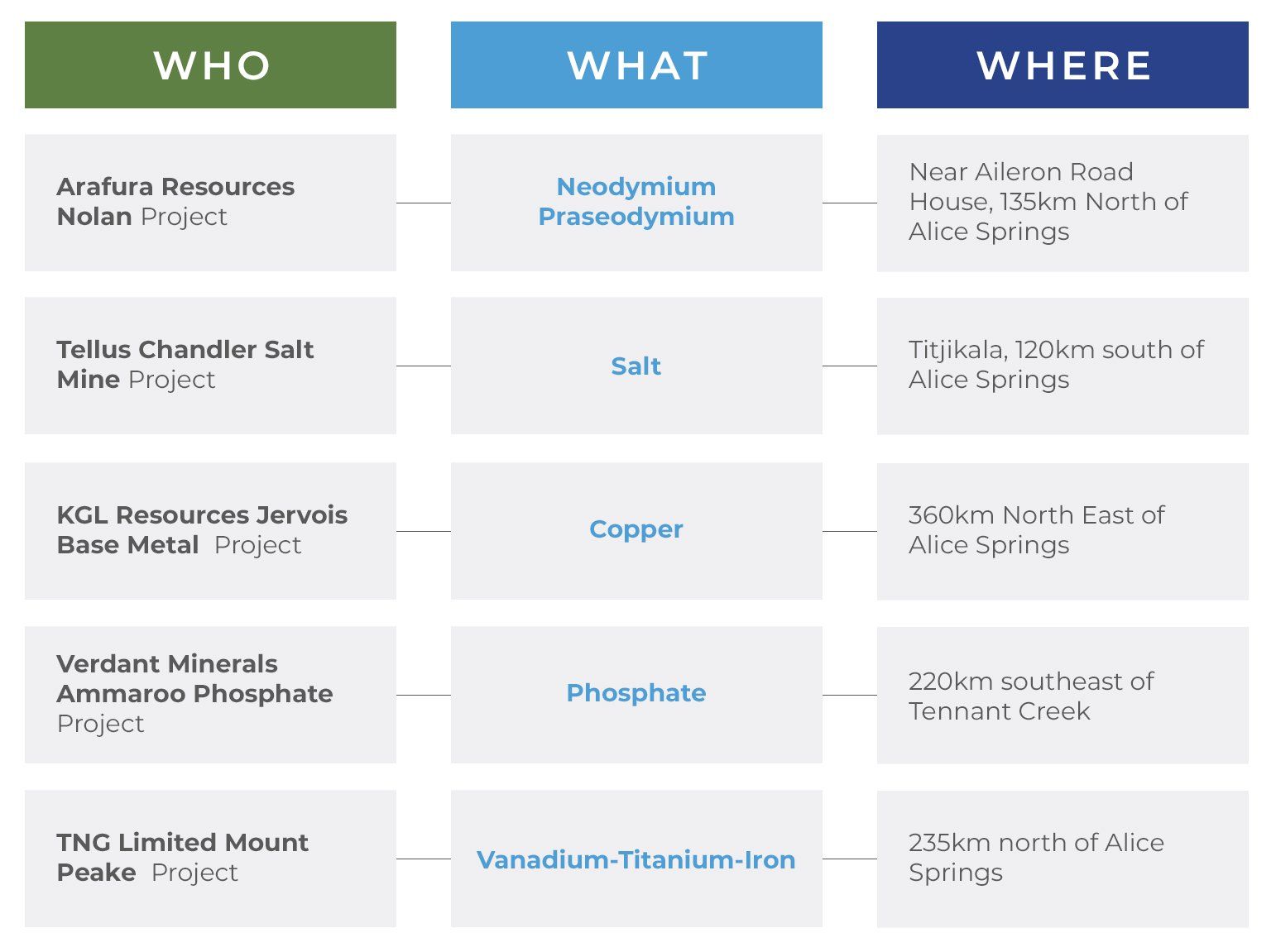

In the Northern Territory (NT), there are 24 projects that have been awarded a Major Project status (private and government-initiated projects). This includes 14 private sector projects and 10 government facilitated projects. Not all of these are mining, however, half of them are mining-related projects. The table illustrates five potential future mine site developments across the Territory. These potential mines are at various planning stages of their respective project cycles. All of which are in the post exploratory phase. While, some of the projects have environmental approvals already placed and are in the assessment phase, others are undergoing the due process. ISACNT had recently been engaged, by the NT Government, to undertake a workforce study investigating the occupations in demand. Investigations were also conducted on both the capability and capacity of the local region near these projects to support the potential opportunities lying ahead.

The mining industry in the Northern Territory (NT) has, after its peak in 2016-2017, employed fewer people due to mining projects closing, finishing or reducing the output of their operations. Nevertheless, due to the rapidly changing nature of the mining industry, this current situation may soon change. A hypothetical scenario of a potential change could occur from a global change in commodity prices or in the demand of certain commodities which in turn would create a boost/decline in employment figures. For example, if the global demand for uranium rises and mining operators within the NT re-assess existing resources or simultaneously discover a new rich uranium resource, this could potentially encourage investment leading to new operations starting which would drive a spike in employment rates extensively within the mining industry.

I am hoping the award of contracts and employment for any potential upcoming mine will be localised; however, the mining proponents may look outside the Northern Territory because stakeholders may not be in the position to bid for contracts due to lack of knowledge and information about the project.

ISACNT - Central Five Mines Workforce Report

Mining industry employment in the Northern Territory 2013-2019

Source: National Institute of Economic and Industry Research (NIEIR), 2019

Workforce

In the current workforce situation in the Northern Territory’s mining industry, there is a range of occupations that are high priority. This means the industry is or expects to be, unable to fill positions within certain occupations in its needed timeframe. Difficulty to fill high priority jobs, limits the mining industry’s efficiency and productivity, consequently, highlighting the importance of gaining more high priority workers to arrive in the Territory. To date, research undertaken by ISACNT illustrates some occupations that the industry considers as high priority occupations:

- civil engineers

- geotechnical engineers

- electrical engineers

- chemical engineers

- mining engineers

- safety inspectors

- glaziers

- geologists

- geophysicists

- environmental scientists

- shotfirers

- fitters

- miners

- diesel motor mechanics

- surveyors

- welders

- drillers

- steel fixers

- plumbers

- mining deputies

- security officers

- truck drivers

- plant operators

- carpenters

- concreters

- painters

- site foremen

- electricians

The research and industry engagement

The research and industry engagement undertaken by ISACNT sheds light on the obstacles standing in the industry’s way of attracting high priority workers to the Northern Territory. The research shows that common issues with attracting high priority workers are that no one with relevant qualifications apply for the positions, or the workers that do apply for the positions lack experience/skills/qualifications/licencing. Furthermore, the workers are often unwilling to move to regional/remote locations. Certain life-phases due to marriage, or starting a family are preventative for some workers to move. Currently, the industry is pursuing to fulfil the employment gaps by utilising a local workforce. If the local workforce is unable to fill the high in-demand occupations, the industry is prepared to take advantage of lucrative fly-in-fly-out agreements to attract talented workforce from around Australia.

The research and industry engagement undertaken by ISACNT sheds light on the obstacles standing in the industry’s way of attracting high priority workers to the Northern Territory. The research shows that common issues with attracting high priority workers are that no one with relevant qualifications apply for the positions, or the workers that do apply for the positions lack experience/skills/qualifications/licencing. Furthermore, the workers are often unwilling to move to regional/remote locations. Certain life-phases due to marriage, or starting a family are preventative for some workers to move. Currently, the industry is pursuing to fulfil the employment gaps by utilising a local workforce. If the local workforce is unable to fill the high in-demand occupations, the industry is prepared to take advantage of lucrative fly-in-fly-out agreements to attract talented workforce from around Australia.

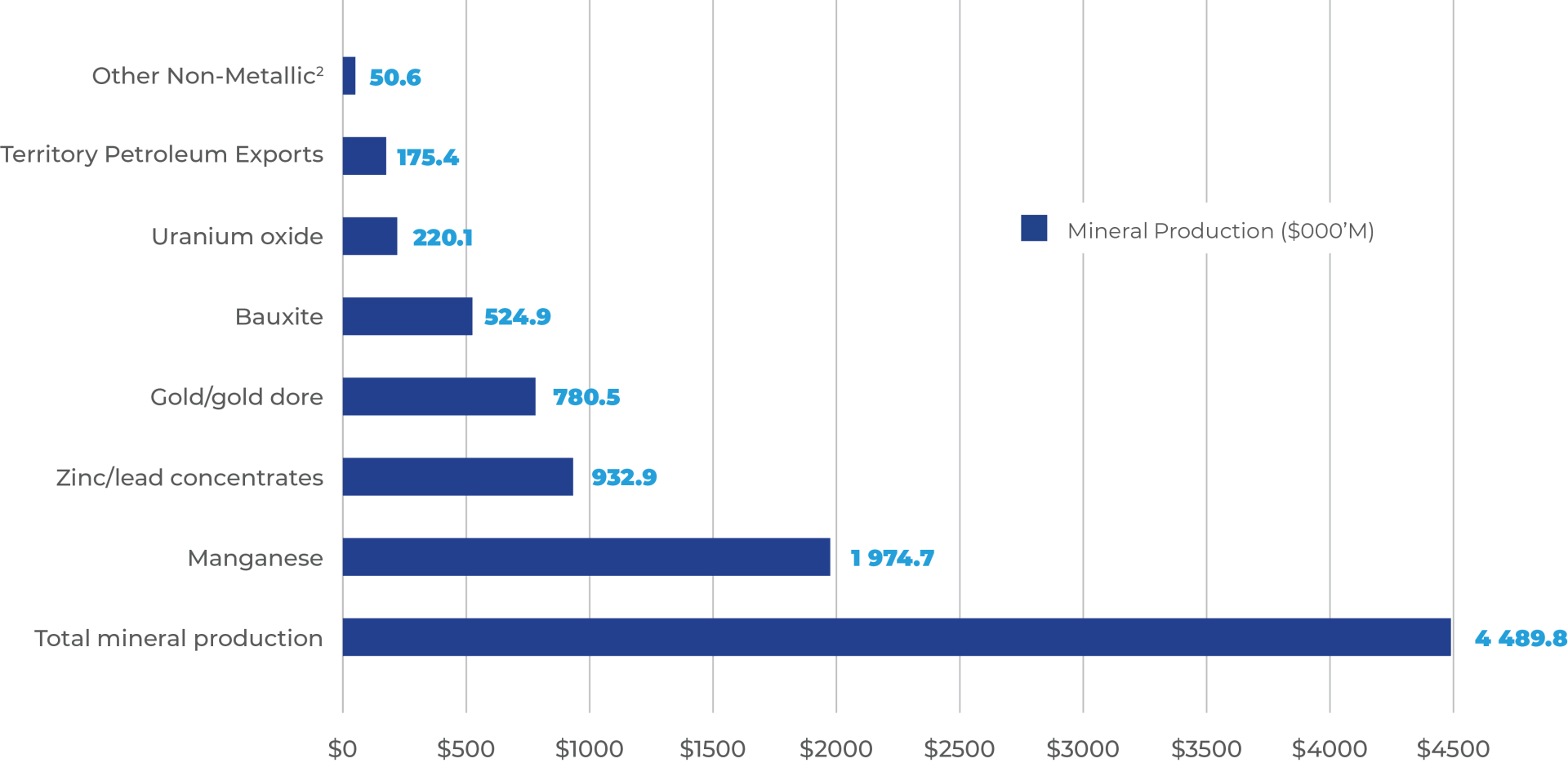

Northern Territory Mineral Production 2017-2018 ($000'M=$BN)

Source: Northern Territory Government, 2020

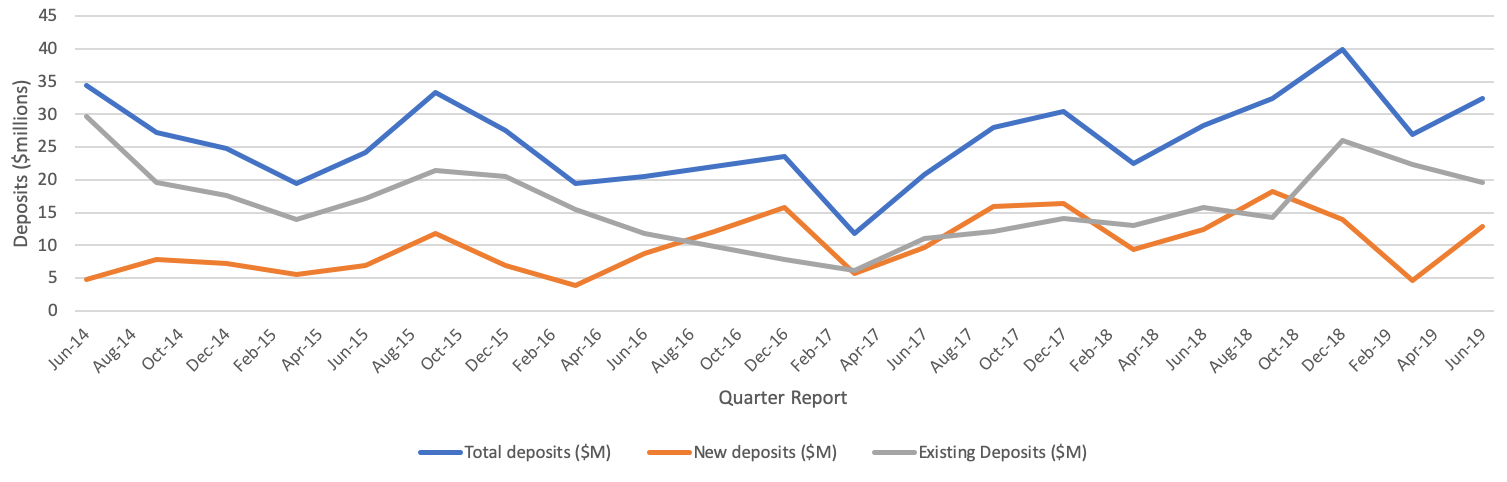

Total Mineral Expenditure Norther Territory ($M)

Source: Australian Bureau of Statistics, 2019

Listed are some of the Northern Territory’s major and smaller operating mines. The categorisation of mines, as listed, is defined by a broad range of factors, for example, the size of the mine’s deposit, relevance of the mined material, and relevance of the market share. Likewise, the mining categorisations are further defined by the mine’s life span. The life span of a mine is determined by the probable, potential and proven resources available at a mine site. A mine with a long-life span is often termed as having over 30 years of operations since the mining industry often cannot predict beyond that time frame, as every mining deposit is contextually dependent on the evolving technology that is embedded in the mining industry and the market’s demand.

Major operating mines

The seven major operating mines and three major oil and gas plants in the Northern Territory are:

- Tanami Operations – Newmont Goldcorp (gold)

- McArthur River mine – Glencore PLC (zinc-lead-silver)

- Groote Eylandt mine – South32 Ltd (manganese)

- Bootu Creek mine – OM Manganese Ltd (manganese)

- Gove mine – Rio Tinto (bauxite)

- Ranger mine – Energy Resources of Australia Ltd (uranium)

- Cosmo Mine – Kirkland Lake Gold Ltd (gold)

- Mereerie – Central Petroleum (oil and gas)

- Palm Valley – Central Petroleum (oil and gas)

- Dingo Oil Field – Central Petroleum (oil and gas).

Smaller operating mines

Smaller operating mines in the Northern Territory include the:

- Edna Beryl gold mine near Tennant Creek

- Dhupuma Plateau bauxite mine near Gove

- Sill 80 ilmenite mine in the Roper region

- Harts Range garnet sand mine in Central Australia.

The Roper Bar iron ore mine in the Roper region (Nathan River Resources) and Merlin diamond mine in the McArthur Basin are currently in a care and maintenance state. However, the mines have the potential to resume operations in the short to medium term.

Mine Rehabilitation

The understanding of natural landscapes that contain the habitat of local flora and fauna has increasingly grown. However, this understanding has not always been common practice within the mining industry. Prior to 2005, there was no legal requirement for mining operators to put down a rehabilitation security bond in the Northern Territory. Mine proponents have in contemporary times invested heavily in mine rehabilitation processes. In recent times, the rehabilitation phase of mining operations has improved. There are now many regulatory requirements, policies and procedures from regulators administrating the industry. These regulations follow protocols that ensure mining operations are compliant, and that the environment is protected in accordance with approved conditions and laws. Mining proponents must also effectively close mining operations and complete the rehabilitation process. As a minimum, the site should be safe and stable adhering to the rehabilitation plans that were written before the closure occurs. These plans must be approved by regulators before rehabilitation activities commence. The closure and rehabilitation design plans are context specific for each mining area’s ecosystem, giving due consideration to restoring the area to as near as possible pre-mining state. The rehabilitation phase of mining operations requires a broad workforce including geologists, engineers, environmental scientists, and labourers to fulfill mining rehabilitation promises to an acceptable level, so governing bodies can sign off and return the rehabilitation security bond. Although mine-site rehabilitation is a legal obligation for all mining projects in the Northern Territory (NT), it is also an activity in which the mining industry can demonstrate its sustainable development commitment to its key stakeholders and the general population.

The Ranger Uranium Mine is a good example of a mine site that is close to exhausting all commodities in the mining process. The stages of the rehabilitation process of the mine site has commenced.

Ongoing rehabilitation of mining legacies across the Territory is a priority, reflecting government’s commitment to sustainable resource development.

Northern Territory Government media release 2020

The Northern Territory (NT) is endowed with an abundance of natural resources-mineral deposits (gold, manganese, bauxite, diamond, iron, copper, zinc, silver, vanadium and titanium, limestone, oil and gas). This map displays the resource distribution of each region (Central, Katherine, Barkly, Darwin and Arnhem) in the Northern Territory. Every region in the Northern Territory is endowed with gold deposits, however, some natural resources are specific to certain regions. For instance, Central and Darwin Regions are the only areas endowed with oil and gas deposits. Notable oil and gas fields include Mereenie, Dingo, Surprise and Blacktip. Bauxite, manganese, zinc, lead and silver occur in the regions of Arnhem, Grove and McArthur River. In the Katherine region, gold is the predominant commodity but other commodities like lime and phosphate are also abundant. To the south in the Central Australian region, there is a range of commodities, gold, iron, vanadium, titanium, rare earths, phosphate, tungsten, molybdenum, copper, silver, oil, gas, salt and potash. The workforce needs of the Northern Territory are critical especially if its resource endowment is to be extracted and fully utilised. In recent research conducted by ISACNT on the workforce needs of the five potential mining projects (as displayed on page 11), it has been revealed an array of shortages in various skills, as previously demonstrated on page 13, exists in the regions of Central and Barkly.

The future of mining is an ever-changing canvas. There is undoubtedly a steep climb ahead as the industry moves towards a continuous digital and automated process. The Australian mining sector has always been at the forefront of innovation, as the nature of the industry demands such action, to ensure the industry remains globally competitive. Workforce requirements may change together with technological advances, which then may affect all facets of the mining industry. For example, digital and innovative mining techniques will influence the workforce needs, as innovations may limit the need for traditional operators. Likewise, the innovations can create further demand for a skilled, technologically knowledgeable workforce, creating a large demand for remote operators, data scientists and modellers which may replace the current core functional support workforce. The digitalisation may, therefore, decrease demand for some occupations from some operations and potentially move workers from the mine sites and locate them more conveniently within larger cities. The innovative changes within the mining industry will, therefore, likely reduce certain types of jobs, however, it may create new roles in other fields. The implications of the specialised skill sets that may be required in the future can evolve in conjunction with technology. The training organisations that aspire to accommodate these changing training requirements must keep up with the pace of the rapidly changing demand in this industry. The industry is best placed to provide feedback and guidance for the skills required for future employees in the mining industry.

"Potential mining developments in the Northern Territory Recent, pending and potential mine developments over the past 24 months and in the next 5 years have identified 22 mine proponents here in the northern territory."

Department of Primary Industry & Resources

Source: Dept Primary Industry & Resources, 2020

Current State

Strenghts

GEO-POLITICAL AND ECONOMIC

- The high remuneration of staff in the industry is an incentive to attract skilled workers

- The Northern Territory (NT) is naturally endowed with a diverse range of mineral commodities

- The geographic location of the NT’s ports make exporting to major markets in the Asia-Pacific Region cheaper and attractive

- The NT has a strong record for being a preferred location for mining (Fraser Report) and this has been reflected by the long precedence of the NT being a major mining state.

- Availability and accessibility of high volumes of geo-scientific data to aid exploratory expeditions of the mining industry

- The mining proponents, both new and existing, have a high level of respect for Indigenous culture

- The mining industry creates supporting infrastructure in and around mine sites and communities, enhancing the industry’s social license.

- The mining industry has a strong understanding of the flora and fauna geology which assists the industry with the rehabilitation in the post-mining phase

- NT’s government population strategy presents opportunity to incentivise workforce attraction

WORKFORCE AND CAPABILITY

- The Northern Territory’s workforce has some exposure to mining operations

- The NT, in comparison to other states, has a lower median age which provides the population with the opportunity to undertake and establish a career in mining

- The majority of the scope of works that are undertaken by mining operators could be covered by local NT suppliers

- Workers gain experience on the mine sites that allows them industry cross-training and upskilling • Proponents of the mining industry continuously support increased numbers of apprenticeships and traineeships

- The Northern Territory provides scholarships for Indigenous workforce to receive relevant training

- There are mine proponents in the NT that have Indigenous workforce programs to develop and skill local Indigenous populations.

TRAINING AND SKILLS

- Registered Training Organisations (RTOs) present in the NT supports vocational training that operates across sectors within the mining industry

- The NT has availability of skilled experts to conduct training to upskill the workforce

- The potential upcoming major mining projects in the NT presents opportunities for the local workforce to undertake further training and skills development

- Enrolment figures in mining related courses in RTOs reflect a keen aptitude in pursuing mining-related careers

Challenges

GEO-POLITICAL AND ECONOMIC

- High overhead costs in the mining sector drive final commodity prices up and impedes potential profits for investors

- Bureaucratic processes at local and state government levels are multi-layered and time sensitive which may lead to delays

- Mining proponents face significant costs when drafting Environmental Impact Statements (EIS) and delays in assessment processes

- Ever changing local and global needs demand industry receptivity to sustain the desire for mineral resources

- The geographic location and remoteness of the Northern Territory creates challenges for the mining industry to freight commodities from remote outback locations

- Mining proponents’ social licenses may be negatively impacted if proponents neglect to fully see through rehabilitation of mine sites (e.g. legacy mines)

- The instability of the Australian Dollar’s strength against the global markets affect exports being extracted from the Northern Territory

WORKFORCE AND CAPABILITY

- The mining industry often relies on an experienced workforce which at times does not include the NT’s local workforce

- The population drain occurring in the Territory continually proves to be an issue state-wide which is affecting the mining industry, as it becomes difficult for the industry to attract workers

- Entry into the mining industry requires a level of skill, experience and qualifications. However, NT’s population may not have some of the requirements to enter the industry.

- The mining industry has challenges gaining its required workforce from only the Northern Territory, forcing the mining industry to seek specific workers from other states

- Attraction of skilled mining workforce to regional/remote areas presents challenges

- The mining industry has large costs and time concerns when upskilling local workforce

- Retention of mining workforce is difficult as workers move where the jobs take them

- The availability of engaging local workforce for mining activities is limited due to low population numbers

- The remote nature of mine sites results in construction and operating issues of maintaining a workforce presence at a mine site.

TRAINING AND SKILLS

- Training gaps identified in the NT, results in reduced delivery in some mining-specific training (e.g. Mining engineers)

- Recent closures of some courses delivered by locally based RTOs in the NT presents difficulty for the workforce to obtain relevant required qualification to enter the mining industry

- RTOs in other states have the requisite resources needed to deliver the curriculum or courses which are absent in the Northern Territory which may lead to NT students securing employment interstate

- Mining related courses in local RTOs have demonstrated lower completion rates

Future State

Opportunities

GEO-POLITICAL AND ECONOMIC

- Exploration of potential mineral/gas deposits may uncover long-life mine sites that may create economic stimulus for the Northern Territory’s (NT) economy

- Increased demand for mined extractions in the global commodity market provides opportunities for the Northern Territory.

- Development of new technologies, will facilitate new employment opportunities across the mining industry

- Existing regulatory frameworks at the national level guide and support mining activities

- Nations with large demand for commodities are looking to expand and enter new markets to lower reliance on larger existing markets, creating an opportunity for the Territory to establish new trade deals

- Pressures from international markets may drive advances in technological innovation within the Australian mining industry

WORKFORCE AND CAPABILITY

- Mining professionals from other states are willing to engage in fly-infly-out occupations, improving the mining industry in the Northern Territory and their ability to gather a required workforce

- Opportunities from the upcoming major projects may act as the catalyst to engage and create work opportunities in regional and remote NT

- Federal Government commitments are in place to support the employment of Indigenous workers

- Federal Government commitments are in place to strengthen the workforce development in regional and remote areas (e.g. Visa 491/494/482 for regional areas to gain more skilled workers)

TRAINING AND SKILLS DEVELOPMENT

- Territorians can utilise interstate based Registered Training Organisations (RTOs) that deliver mining-related courses ensuring workers return with right qualifications to enter the NT mining industry

- The provision of placement programs is enhancing NT student’s knowledge and skill sets which is providing them with better employment opportunities for entering the workforce

- Queensland based RTOs have introduced a Diploma in mining which is in conjunction with training providers in the Northern Territory, creating the potential to stimulate and bolster training numbers

- Developments in technology and the potential commencement of the major mining projects may boost the appetite of local RTOs to deliver more mining related courses or incentivise out of state RTOs to have a presence in the NT

Threats

GEO-POLITICAL AND ECONOMIC

- Perceived difficulty in obtaining administrative clearances to conduct operations may hinder mining exploratory activities

- There are potential superpowers in the Asia-Pacific Region that are naturally resource rich creating competition for the Northern Territory’s mining industry

- Fluctuating commodity prices may hinder mining operations in the NT

- The Asia-Pacific Region can utilise cheaper labour costs resulting in lower commodity prices for the mining industry to extract and process commodities

- Competing markets in the Asia-Pacific Region may incentivise investors to invest in markets outside Australia lured by the potential of more lucrative returns

- Overbearing regulatory processes may discourage potential mine proponents to engage in activities located within the NT

WORKFORCE AND CAPABILITY

- The NT is competing with other mining states like Western Australia and Queensland to attract skilled workers

- Western Australia and Queensland have a highly skilled, highly mobile workforce that can encroach on NT’s local workforce to work on mining projects

- The use of fly-in fly-out workers impinge upon local workforce development in a long-term perspective, as it removes the motivation for the mining industry to upskill and utilise the local workforce

- Federal changes have occurred to Visa (491/494) for regional areas, changing the categorisation of what areas qualify as regional centres. Areas like Perth and Gold Coast are now considered regional centres, making the Northern Territory less attractive for migrants

TRAINING AND SKILLS DEVELOPMENT

- Interstate trained Territorians in the mining industry may not return to the local workforce securing work interstate

- The Northern Territory presents limited availability in course ranges in comparison to other states/territories that have multiple RTO providers.

- Deficiencies of long-term commitment of NT workforce to complete qualifications of desired skill sets necessary to the mining industry

- As the industry heads towards automation certain job skills and roles will require upskilling and further training

- The development of new technologies may be a challenge for RTOs to update their curriculum and resources to execute the delivery of training.

Easy access to geological and exploration information increases efficiency and makes the Territory a more attractive place for industry to invest. The information will assist in the exploration and discovery of new mineral resources to grow the Territory’s economy;

Ken Vowles - Former Minister for Primary Industry & Resources

Occupations

ELECTRICIAN (GENERAL)

ANZSCO #341111 Installs, tests, connects, commissions, maintains and modifies electrical equipment, wiring and control systems. Registration or licensing is required.

Skill Level: 3

OR

Certificate III in Electrical Fitting

ENVIRONMENTAL RESEARCH SCIENTIST

GEOLOGIST/GEOPHYSICIST

GEOLOGIST ANZSCO # 234411

Studies the composition, structure and other physical attributes of the earth to increase scientific knowledge and to develop practical applications in fields such as mineral exploitation, civil engineering, environmental protection and rehabilitation of land after mining.

Skill Level: 1

GEOPHYSICIST ANZSCO #234412

Studies the composition, structure and other physical attributes of the earth, locates minerals, petroleum or groundwater, and detects, monitors and forecasts seismic, magnetic, electrical, geothermal and oceanographic activity.

Skill level: 1

engineers

ELECTRICAL ENGINEER ANZSCO #233311

Designs, develops and supervises the manufacture, installation, operation and maintenance of equipment, machines and systems for the generation, distribution, utilisation and control of electric power. Registration or licensing may be required.

Skill Level: 1

CIVIL ENGINEER ANZSCO #233211

Plans, designs, organises and oversees the construction and operation of dams, bridges, pipelines, gas and water supply schemes, sewerage systems, airports and other civil engineering projects. Registration or licensing may be required.

Skill Level: 1

STRUCTURAL ENGINEER ANZSCO #233214

Analyses the statistical properties of all types of structures, tests the behaviour and durability of materials used in their construction, and designs and supervises the construction of all types of structures. Registration or licensing may be required.

Skill Level: 1

MINING ENGINEER ANZSCO #233611

Plans and directs the engineering aspects of locating and extracting minerals from the earth. Registration or licensing may be required.

Skill Level: 1

OR

Bachelor of Mining Engineering (Honours)

project manager

ANZSCO # 511112

Plans, organises, directs, controls and coordinates the engineering and technical operations of an organisation. Registration or licensing is required.

Skill Level: 1

OR

Certificate IV in Leadership and Management

carpenter and joiner

CHEMICAL, GAS, PETROLEUM AND POWER GENERATION PLANT OPERATOr

ANZSCO # 399211, 399212, 399213

Control the operation of chemical production equipment, pump gas and oil from wellheads, refine and process petroleum products, and operate boilers, turbogenerators and associated plant to generate electrical power. Registration or licensing is required.

Skill Level: 3

Mining operations support occupations

EXCAVATOR OPERATORS – GRADER OPERATOR – TRUCK DRIVER (GENERAL)

ANZSCO # 721214 / 721215 / 733111

Operates heavy excavation plant to excavate, move and load earth, rock and rubble. Registration or licensing is required.

Skill Level: 5

OR

Certificate III in Civil Construction Plant Operations

OR

Certificate III in Driving Operations

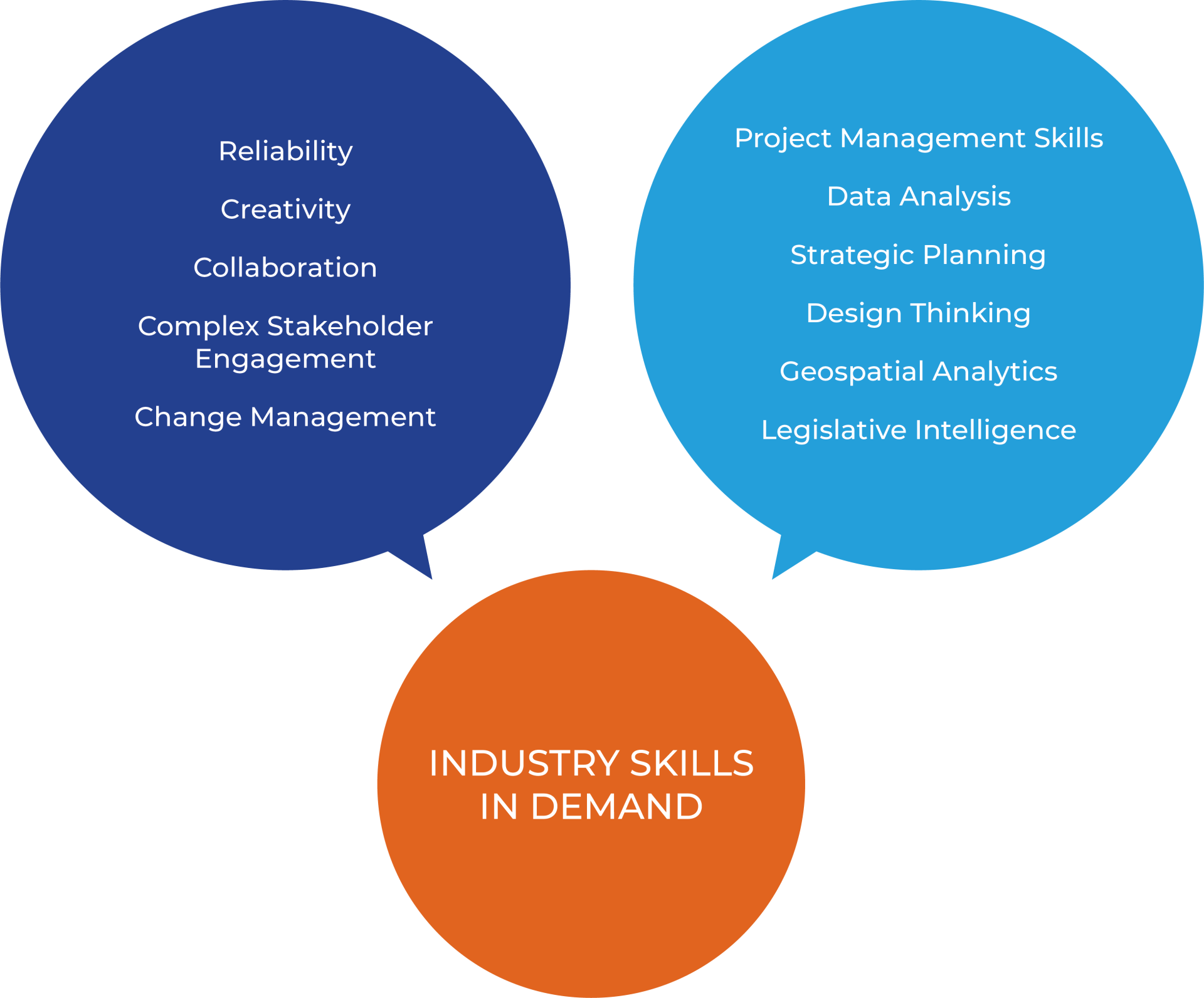

The diagram depicts the hard and soft skills that the industry is looking for from its workforce

Source: ISACNT (2019), Mining Skills Australia (2019), Ernest & Young (2019)

Enrolments and Completions

Disclaimer Privacy Policy

Website designed and developed by Captovate